Page 17 - CityofForestHillFY26Budget

P. 17

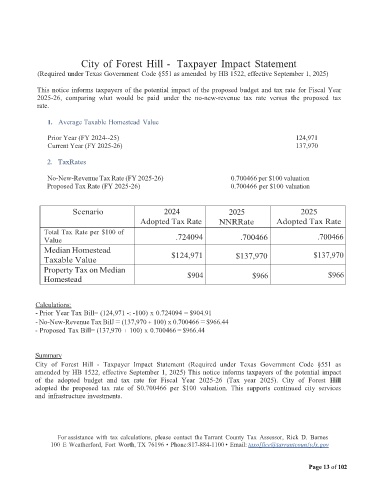

City of Forest Hill - Taxpayer Impact Statement

(Required under Texas Government Code §551 as amended by HB 1522, effective September 1, 2025)

This notice informs taxpayers of the potential impact of the proposed budget and tax rate for Fiscal Year

2025-26, comparing what would be paid under the no-new-revenue tax rate versus the proposed tax

rate.

1. Average Taxable Homestead Value

Prior Year (FY 2024--25) 124,971

Current Year (FY 2025-26) 137,970

2. TaxRates

No-New-Revenue Tax Rate (FY 2025-26) 0.700466 per $100 valuation

Proposed Tax Rate (FY 2025-26) 0.700466 per $100 valuation

Scenario 2024 2025 2025

Adopted Tax Rate NNRRate Adopted Tax Rate

Total Tax Rate per $100 of

Value .724094 .700466 .700466

Median Homestead

Taxable Value $124,971 $137,970 $137,970

Property Tax on Median $966

Homestead $904 $966

Calculations:

- Prior Year Tax Bill= (124,971 -: -100) x 0.724094 = $904.91

- No-New-Revenue Tax BilJ = (137,970 + 100) x 0.700466 = $966.44

- Proposed Tax Bill= (137,970 + 100) x 0.700466 = $966.44

Summary

City of Forest Hill - Taxpayer Impact Statement (Required under Texas Government Code §551 as

amended by HB 1522, effective September 1, 2025) This notice informs taxpayers of the potential impact

of the adopted budget and tax rate for Fiscal Year 2025-26 (Tax year 2025). City of Forest Hill

adopted the proposed tax rate of S0.700466 per $100 valuation. This supports continued city services

and infrastructure investments.

For assistance with tax calculations, please contact the Tarrant County Tax Assessor, Rick D. Barnes

100 E Weatherford, Fort Worth, TX 76196 • Phone:817-884-1100 • Email: taxo[fice@tarrantcoun{yJx.gov

Page 13 of 102