Page 12 - CityofForestHillFY26Budget

P. 12

CITY OF FOREST HILL

AD VALOREM TAXES –PROPOSED RATE

This budget is built on a tax rate of $.700466 per $100 valuation.

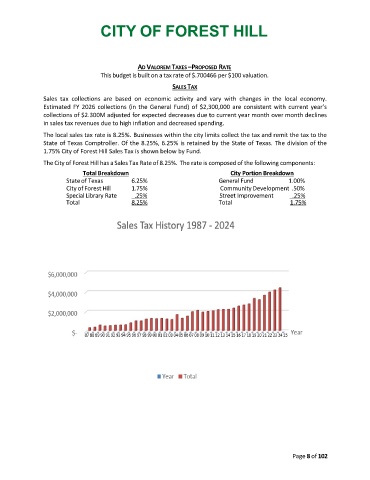

SALES TAX

Sales tax collections are based on economic activity and vary with changes in the local economy.

Estimated FY 2026 collections (in the General Fund) of $2,300,000 are consistent with current year’s

collections of $2.300M adjusted for expected decreases due to current year month over month declines

in sales tax revenues due to high inflation and decreased spending.

The local sales tax rate is 8.25%. Businesses within the city limits collect the tax and remit the tax to the

State of Texas Comptroller. Of the 8.25%, 6.25% is retained by the State of Texas. The division of the

1.75% City of Forest Hill Sales Tax is shown below by Fund.

The City of Forest Hill has a Sales Tax Rate of 8.25%. The rate is composed of the following components:

Total Breakdown City Portion Breakdown

State of Texas 6.25% General Fund 1.00%

City of Forest Hill 1.75% Community Development .50%

Special Library Rate .25% Street Improvement .25%

Total 8.25% Total 1.75%

Page 8 of 102