Page 55 - CityofEulessFY26AdoptedBudgetOrdinance2432

P. 55

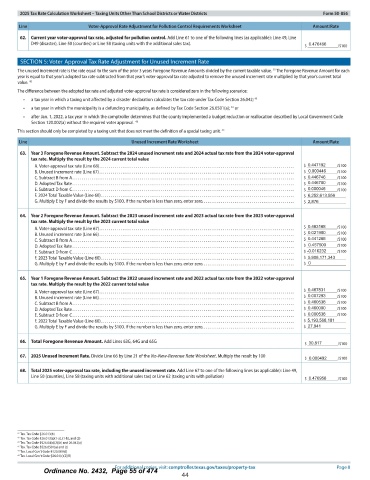

2025 Tax Rate Calculation Worksheet - Taxing Units Other Than School Districts or Water Districts Form 50- 856

ount/ Rate

62. Current year voter -approval tax rate, adjusted for pollution control. Add Line 61 to one of the following lines ( as applicable): Line 49, Line

D49 ( disaster), Line 50 ( counties) or Line 58 ( taxing units with the additional sales tax). 0. 476466 /$

100

SECTION 5: Voter Approval Tax Rate Adjustment for Unused Increment Rate

The unused increment rate is the rate equal to the sum of the prior 3 years Foregone Revenue Amounts divided by the current taxable value. 39 The Foregone Revenue Amount for each

year is equal to that year's adopted tax rate subtracted from that year's voter -approval tax rate adjusted to remove the unused increment rate multiplied by that year's current total

value. 40

The difference between the adopted tax rate and adjusted voter -approval tax rate is considered zero in the following scenarios:

a tax year in which a taxing unit affected by a disaster declaration calculates the tax rate under Tax Code Section 26. 042; 41

a tax year in which the municipality is a defunding municipality, as defined by Tax Code Section 26. 0501( a); 42 or

after Jan. 1, 2022, a tax year in which the comptroller determines that the county implemented a budget reduction or reallocation described by Local Government Code

Section 120.002(a) without the required voter approval. 43

This section should only be completed by a taxing unit that does not meet the definition of a special taxing unit. a4

63. Year 3 Foregone Revenue Amount. Subtract the 2024 unused increment rate and 2024 actual tax rate from the 2024 voter - approval

tax rate. Multiply the result by the 2024 current total value

A. Voter -approval tax rate (Line 68) $ 0. 447192 /$ 100

B. Unused increment rate (Line 67) $ 0. 000446 /$ 100

C. Subtract B from A $ 0. 446746 /$ 100

D. Adopted Tax Rate $ 0. 446700 /$ 100

E. Subtract D from C $ 0. 000046 /$ 100

F. 2024 Total Taxable Value ( Line 60) $ 6, 252, 613, 556

G. Multiply E by F and divide the results by $ 100. If the number is less than zero, enter zero $ 2, 876

64. Year 2 Foregone Revenue Amount. Subtract the 2023 unused increment rate and 2023 actual tax rate from the 2023 voter - approval

tax rate. Multiply the result by the 2023 current total value

0. 463168 /$

A. Voter -approval tax rate (Line 67) 100

0. 021900 /$

B. Unused increment rate ( Line 66) 100

0. 441268 /$

C. Subtract B from A 100

0.457500 /$

D. Adopted Tax Rate 100

E. Subtract D from C 0. 016232 /$ 100

F. 2023 Total Taxable Value ( Line 60) 5. 908. 171. 343

G. Multiply E by F and divide the results by $ 100. If the number is less than zero, enter zero 0

65. Year 1 Foregone Revenue Amount. Subtract the 2022 unused increment rate and 2022 actual tax rate from the 2022 voter -approval

tax rate. Multiply the result by the 2022 current total value

0. 467831 /$ 100

A. Voter - approval tax rate ( Line 67)

0. 007293 /$

B. Unused increment rate ( Line 66) 100

0. 460538 /$

C. Subtract B from A 100

0. 460000 /$

D. Adopted Tax Rate 100

E. Subtract D from C 0. 000538 /$ 100

F. 2022 Total Taxable Value ( Line 60) 5, 193, 568, 181

G. Multiply E by F and divide the results by $ 100. If the number is less than zero, enter zero 27, 941

66. Total Foregone Revenue Amount. Add Lines 63G, 64G and 65G

30. 817 /$ 100

67. 2025 Unused Increment Rate. Divide Line 66 by Line 21 of the No -New -Revenue Rate Worksheet. Multiply the result by 100

0. 000492 /$ 100

68. Total 2025 voter -approval tax rate, including the unused increment rate. Add Line 67 to one of the following lines ( as applicable): Line 49,

Line 50 ( counties), Line 58 ( taxing units with additional sales tax) or Line 62 ( taxing units with pollution) 0. 476958 /$ 100

Tex. Tax Code § 26. 013( b)

Tex. Tax Code § 26. 013( a)( 1- a), ( 1- b), and ( 2)

1 Tex. Tax Code §§ 26. 04( c)( 2)( A) and 26. 042( a)

Tex. Tax Code §§ 26. 0501( a) and ( c)

Tex. Local Gov' t Code § 120. 007( d)

94 Tex. Local Gov' t Code § 26. 04( c)( 2)( B)

o ? visit: comptroller. texas. gov/ taxes/ property- tax Page 8

Ordinance No. 2432, PFagedgipnaa 4

44