Page 30 - CityofEulessFY26AdoptedBudgetOrdinance2432

P. 30

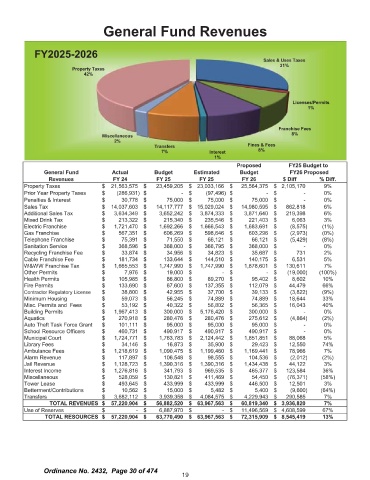

General Fund Revenues

FY2025- 2026

Sales & Uses Taxes

31%

Property Taxes

42%

Licenses/ Permits

1%

Franchise Fees

8%

Miscellaneous -

2%

Fines & Fees

Transfers

8%

7% Interest

1%

Proposed FY25 Budget to

General Fund Actual Budget Estimated Budget FY26 Proposed

Revenues FY 24 FY 25 FY 25 FY 26 Diff % Diff.

Property Taxes 21, 563, 575 $ 23, 459, 205 $ 23, 033, 166 $ 25, 564, 375 $ 2, 105, 170 9%

Prior Year Property Taxes 286, 931) $ - $ ( 97, 496) $ - $ 0%

Penalties & Interest 30, 778 $ 75, 000 $ 75, 000 $ 75, 000 $ 0%

Sales Tax 14, 037, 603 $ 14, 117, 777 $ 15, 029, 024 $ 14, 980, 595 $ 862, 818 6%

Additional Sales Tax 3, 634, 349 $ 3, 652, 242 $ 3, 874, 333 $ 3, 871, 640 $ 219, 398 6%

Mixed Drink Tax 213, 322 $ 215, 340 $ 235, 546 $ 221, 403 $ 6, 063 3%

Electric Franchise 1, 721, 470 $ 1, 692, 266 $ 1, 666, 543 $ 1, 683, 691 $ 8, 575) ( 1%)

Gas Franchise 567, 351 $ 606, 269 $ 598, 646 $ 603, 296 $ 2, 973) ( 0%)

Telephone Franchise 75, 391 $ 71, 550 $ 66, 121 $ 66, 121 $ 5, 429) 8%)

Sanitation Service 368, 596 $ 368, 000 $ 366, 795 $ 368, 000 $ 0%

Recycling Franchise Fee 33, 874 $ 34, 956 $ 34, 823 $ 35, 687 $ 731 2%

Cable Franchise Fee 181, 734 $ 133, 644 $ 144, 510 $ 140, 175 $ 6, 531 5%

W& WW Franchise Tax 1, 665, 553 $ 1, 747, 990 $ 1, 747, 990 $ 1, 878, 601 $ 130, 611 7%

Other Permits 7, 976 $ 19, 000 $ - $ - $ 19, 000) 100%)

Health Permits 105, 985 $ 86, 800 $ 89, 270 $ 95, 402 $ 8, 602 10%

Fire Permits 133, 690 $ 67, 600 $ 137, 355 $ 112, 079 $ 44, 479 66%

Contractor Regulatory License 38, 800 $ 42, 955 $ 37, 700 $ 39, 133 $ 3, 822) 9%)

Minimum Housing 59, 073 $ 56, 245 $ 74, 889 $ 74, 889 $ 18, 644 33%

Misc. Permits and Fees 53, 192 $ 40, 322 $ 56, 802 $ 56, 365 $ 16, 043 40%

Building Permits 1, 967, 413 $ 300, 000 $ 5, 176, 420 $ 300, 000 $ 0%

Aquatics 270, 918 $ 280, 476 $ 280, 476 $ 275, 612 $ 4, 864) 2%)

Auto Theft Task Force Grant 101, 111 $ 95, 000 $ 95, 000 $ 95, 000 $ 0%

School Resource Officers 460, 731 $ 490, 917 $ 490, 917 $ 490, 917 $ 0%

Municipal Court 1, 724, 771 $ 1, 763, 783 $ 2, 124, 442 $ 1, 851, 851 $ 88, 068 5%

Library Fees 34, 146 $ 16, 873 $ 35, 900 $ 29, 423 $ 12, 550 74%

Ambulance Fees 1, 218, 619 $ 1, 090, 475 $ 1, 199, 460 $ 1, 169, 441 $ 78, 966 7%

Alarm Revenue 117, 897 $ 106, 548 $ 98, 555 $ 104, 536 $ 2, 012) 2%)

Jail Revenue 1, 128, 723 $ 1, 390, 316 $ 1, 390, 316 $ 1, 434, 438 $ 44, 122 3%

Interest Income 1, 276, 816 $ 341, 793 $ 969, 535 $ 465, 377 $ 123, 584 36%

Miscellaneous 528, 059 $ 130, 821 $ 411, 469 $ 54, 450 $ 76, 371) 58%)

Tower Lease 493, 645 $ 433, 999 $ 433, 999 $ 446, 500 $ 12, 501 3%

Betterment/ Contributions 10, 562 $ 15, 000 $ 5, 482 $ 5, 400 $ 9, 600) 64%)

Transfers 3, 682, 112 $ 3, 939, 358 $ 4, 084, 575 $ 4, 229, 943 $ 290, 585 7%

TOTAL REVENUES 57, 220, 904 $ 56, 882, 520 $ 63, 967, 563 $ 60, 819, 340 $ 3, 936, 820 7%

Use of Reserves 6, 887, 970 $ - $ 11, 496, 569 $ 4, 608, 599 67%

TOTAL RESOURCES 57, 220, 904 $ 63, 770, 490 $ 63, 967, 563 $ 72, 315, 909 $ 8, 545, 419 13%

Ordinance No. 2432, Page 30 of 474

19