Page 120 - CityofEulessFY26AdoptedBudgetOrdinance2432

P. 120

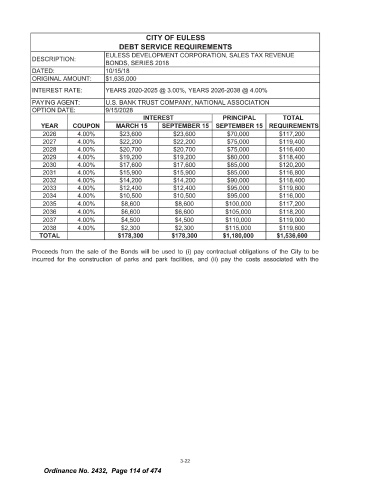

CITY OF EULESS

DEBT SERVICE REQUIREMENTS

EULESS DEVELOPMENT CORPORATION, SALES TAX REVENUE

DESCRIPTION:

BONDS, SERIES 2018

DATED: 10/ 15/ 18

ORIGINAL AMOUNT: 1, 635, 000

INTEREST RATE: YEARS 2020- 2025 @ 3. 00%, YEARS 2026-2038 @ 4. 00%

PAYING AGENT: U. S. BANK TRUST COMPANY, NATIONAL ASSOCIATION

OPTION DATE: 9/ 15/ 2028

INTEREST PRINCIPAL TOTAL

YEAR COUPON MARCH 15 SEPTEMBER 15 SEPTEMBER 15 REQUIREMENTS

2026 4. 00% $ 23, 600 $ 23, 600 $ 70, 000 $ 117, 200

2027 4. 00% $ 22, 200 $ 22, 200 $ 75, 000 $ 119, 400

2028 4. 00% $ 20, 700 $ 20, 700 $ 75, 000 $ 116, 400

2029 4. 00% $ 19, 200 $ 19, 200 $ 80, 000 $ 118, 400

2030 4. 00% $ 17, 600 $ 17, 600 $ 85, 000 $ 120, 200

2031 4. 00% $ 15, 900 $ 15, 900 $ 85, 000 $ 116, 800

2032 4. 00% $ 14, 200 $ 14, 200 $ 90, 000 $ 118, 400

2033 4. 00% $ 12, 400 $ 12, 400 $ 95, 000 $ 119, 800

2034 4. 00% $ 10, 500 $ 10, 500 $ 95, 000 $ 116, 000

2035 4. 00% $ 8, 600 $ 8, 600 $ 100, 000 $ 117, 200

2036 4. 00% $ 6, 600 $ 6, 600 $ 105, 000 $ 118, 200

2037 4. 00% $ 4, 500 $ 4, 500 $ 110, 000 $ 119, 000

2038 4. 00% $ 2, 300 $ 2, 300 $ 115, 000 $ 119, 600

TOTAL $ 178, 300 $ 178, 300 $ 1, 180, 000 $ 1, 536, 600

Proceeds from the sale of the Bonds will be used to ( i) pay contractual obligations of the City to be

incurred for the construction of parks and park facilities, and ( ii) pay the costs associated with the

3- 22

Ordinance No. 2432, Page 114 of 474