Page 119 - CityofEulessFY26AdoptedBudgetOrdinance2432

P. 119

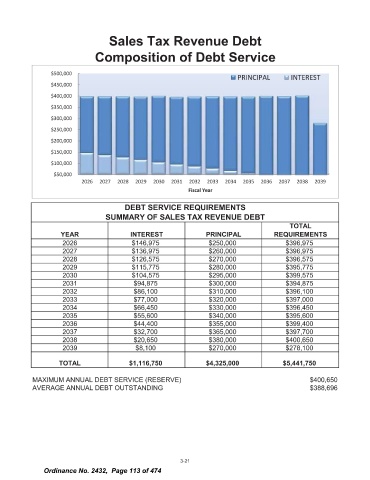

Sales Tax Revenue Debt

Composition of Debt Service

500, 000

PRINCIPAL INTEREST

450, 000

400, 000

350, 000

300, 000

250, 000

200, 000

150, 000

100, 000

50, 000

2026 2027 2028 2029 2030 2031 2032 2033 2034 2035 2036 2037 2038 2039

Fiscal Year

DEBT SERVICE REQUIREMENTS

SUMMARY OF SALES TAX REVENUE DEBT

TOTAL

YEAR INTEREST PRINCIPAL REQUIREMENTS

2026 $ 146, 975 $ 250, 000 $ 396, 975

2027 $ 136, 975 $ 260, 000 $ 396, 975

2028 $ 126, 575 $ 270, 000 $ 396, 575

2029 $ 115, 775 $ 280, 000 $ 395, 775

2030 $ 104, 575 $ 295, 000 $ 399, 575

2031 $ 94, 875 $ 300, 000 $ 394, 875

2032 $ 86, 100 $ 310, 000 $ 396, 100

2033 $ 77, 000 $ 320, 000 $ 397, 000

2034 $ 66, 450 $ 330, 000 $ 396, 450

2035 $ 55, 600 $ 340, 000 $ 395, 600

2036 $ 44, 400 $ 355, 000 $ 399, 400

2037 $ 32, 700 $ 365, 000 $ 397, 700

2038 $ 20, 650 $ 380, 000 $ 400, 650

2039 $ 8, 100 $ 270, 000 $ 278, 100

TOTAL $ 1, 116, 750 $ 4, 325, 000 $ 5, 441, 750

MAXIMUM ANNUAL DEBT SERVICE ( RESERVE) 400, 650

AVERAGE ANNUAL DEBT OUTSTANDING 388, 696

3- 21

Ordinance No. 2432, Page 113 of 474