Page 6 - CityofDalworthingtonGardensFY26AdoptedBudget

P. 6

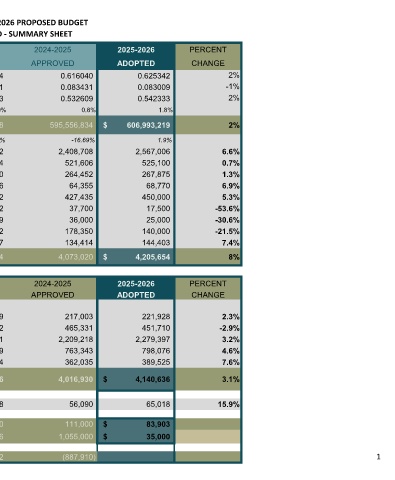

FISCAL YEAR 2025-2026 PROPOSED BUDGET

GENERAL FUND - SUMMARY SHEET

2022-2023 2023-2024 2024-2025 2025-2026 PERCENT

REVENUES

ACTUAL ACTUAL APPROVED ADOPTED CHANGE

TOTAL AD VALOREM TAX RATE 0.665133 0.611854 0.616040 0.625342 2%

LESS: I&S TAX RATE 0.097417 0.083431 0.083431 0.083009 -1%

M&O TAX RATE/ $100 VALUATION 0.567716 0.528423 0.532609 0.542333 2%

YEAR-OVER-YEAR M&O COMPARISON -2.4% -6.9% 0.8% 1.8%

TAXABLE VALUATION 563,647,968 595,556,834 $ 606,993,219 2%

-22.20% -16.69% 1.9%

Property Taxes 2,205,048 2,279,262 2,408,708 2,567,006 6.6%

Sales / Beverage Taxes 581,283 526,384 521,606 525,100 0.7%

Franchise Fees 293,161 262,900 264,452 267,875 1.3%

Permits/ Fees 73,634 126,796 64,355 68,770 6.9%

Fines / Fees 328,700 416,772 427,435 450,000 5.3%

Charge for Services 15,805 34,592 37,700 17,500 -53.6%

Gas Royalties 138,901 42,509 36,000 25,000 -30.6%

Other Revenue 166,877 224,842 178,350 140,000 -21.5%

Other Sources 89,655 92,717 134,414 144,403 7.4%

TOTAL REVENUES 3,893,063 4,006,774 4,073,020 $ 4,205,654 8%

EXPENDITURES 2022-2023 2023-2024 2024-2025 2025-2026 PERCENT

ACTUAL ACTUAL APPROVED ADOPTED CHANGE

Community Development

Court 181,989 203,609 217,003 221,928 2.3%

Administration 397,665 383,452 465,331 451,710 -2.9%

Police 1,887,833 1,944,351 2,209,218 2,279,397 3.2%

Fire 430,906 655,959 763,343 798,076 4.6%

Public Works 162,676 332,274 362,035 389,525 7.6%

TOTAL EXPENDITURES 3,061,069 3,519,646 4,016,930 $ 4,140,636 3.1%

Total Revenues Over (Under) Exp 831,995 487,128 56,090 65,018 15.9%

TOTAL Transfer In 66,000 66,000 111,000 $ 83,903

TOTAL Transfer Out 771,892 140,756 1,055,000 $ 35,000

NET CHANGE IN FUND BALANCE 126,103 412,372 (887,910) 1