Page 51 - ClearGov | Documents

P. 51

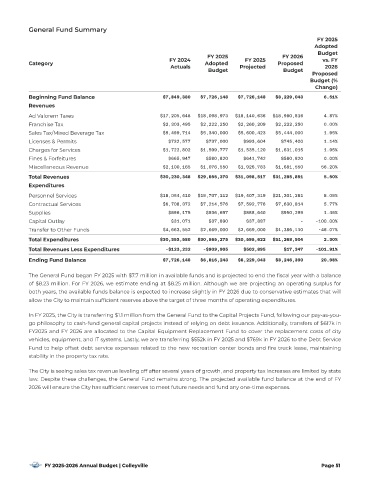

General Fund Summar y

FY 2025

Adopted

Budget

FY 2025 FY 2026

FY 2024 FY 2025 vs. FY

Category Adopted Proposed

Actuals Projected 2026

Budget Budget

Proposed

Budget (%

Change)

$7,849,380 $7,726,148 $7,726,148 $8,229,043 6.51%

Beginning Fund Balance

Revenues

$17,205,648 $18,098,973 $18,140,636 $18,980,816 4.87%

Ad Valorem Taxes

$2,303,495 $2,222,250 $2,260,209 $2,222,250 0.00%

Franchise Tax

$5,499,714 $5,340,000 $5,600,423 $5,444,000 1.95%

Sales Tax /Mixed Beverage Tax

$732,577 $737,000 $993,604 $745,400 1.14%

Licenses & Permits

$1,722,802 $1,599,777 $1,535,120 $1,631,015 1.95%

Charges for Ser vices

$665,947 $580,820 $641,742 $580,820 0.00%

Fines & Forfeitures

Miscellaneous Revenue $2,100,165 $1,076,550 $1,926,783 $1,681,550 56.20%

Total Revenues $30,230,348 $29,655,370 $31,098,517 $31,285,851 5.50%

Expenditures

Personnel Ser vices $18,054,410 $19,707,112 $19,407,319 $21,301,281 8.09%

Contractual Ser vices $6,708,372 $7,214,576 $7,592,776 $7,630,814 5.77%

Supplies $896,175 $936,697 $888,640 $950,299 1.45%

Capital Outlay $31,071 $37,890 $37,887 - -100.00%

$4,663,552 $2,669,000 $2,669,000 $1,386,110 -48.07%

Transfer to Other Funds

$30,353,580 $30,565,275 $30,595,622 $31,268,504 2.30%

Total Expenditures

-$123,232 -$909,905 $502,895 $17,347 -101.91%

Total Revenues Less Expenditures

$7,726,148 $6,816,243 $8,229,043 $8,246,390 20.98%

Ending Fund Balance

The General Fund began FY 2025 with $7.7 million in available funds and is projected to end the {scal year with a balance

of $8 . 23 million. For FY 2026 , we estimate ending at $8 . 25 million. Although we are projecting an operating surplus for

both years, the available funds balance is expected to increase slightly in FY 2026 due to conser vative estimates that will

allow the City to maintain suf{cient reser ves above the target of three months of operating expenditures.

In FY 2025, the City is transferring $1.1 million from the General Fund to the Capital Projects Fund, following our pay-as-you-

go philosophy to cash-fund general capital projects instead of relying on debt issuance. Additionally, transfers of $617k in

FY2025 and FY 2026 are allocated to the Capital Equipment Replacement Fund to cover the replacement costs of city

vehicles, equipment , and IT systems. Lastly, we are transferring $552k in FY 2025 and $769k in FY 2026 to the Debt Ser vice

Fund to help offset debt ser vice expenses related to the new recreation center bonds and {re truck lease, maintaining

stability in the proper ty tax rate.

The City is seeing sales tax revenue leveling off after several years of growth, and proper ty tax increases are limited by state

law. Despite these challenges, the General Fund remains strong. The projected available fund balance at the end of FY

2026 will ensure the City has suf{cient reser ves to meet future needs and fund any one - time expenses.

FY 2025-2026 Annual Budget | Colleyville Page 51