Page 11 - ClearGov | Documents

P. 11

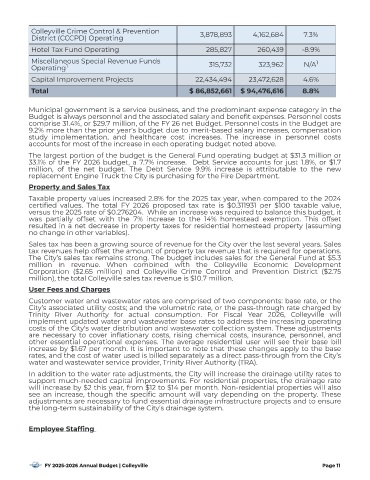

Colleyville Crime Control & Prevention

3,878,893 4 ,162,684 7.3%

District (CCCPD) Operating

Hotel Tax Fund Operating 285,827 260,439 -8.9%

Miscellaneous Special Revenue Funds

1

315,732 323,962 N/A

1

Operating

Capital Improvement Projects 22,434 ,494 23,472,628 4 .6%

Total $ 86,852,661 $ 94 ,476,616 8.8%

Municipal government is a service business, and the predominant expense category in the

Budget is always personnel and the associated salary and bene{t expenses. Personnel costs

comprise 31.4% , or $29.7 million, of the FY 26 net Budget. Personnel costs in the Budget are

9.2% more than the prior year's budget due to merit-based salary increases, compensation

study implementation, and healthcare cost increases. The increase in personnel costs

accounts for most of the increase in each operating budget noted above.

The largest portion of the budget is the General Fund operating budget at $31.3 million or

33.1% of the FY 2026 budget, a 7.7% increase. Debt Service accounts for just 1.8% , or $1.7

million, of the net budget. The Debt Service 9.9% increase is attributable to the new

replacement Engine Truck the City is purchasing for the Fire Department.

Proper ty and Sales Tax

Taxable property values increased 2.8% for the 2025 tax year, when compared to the 2024

certi{ed values. The total FY 2026 proposed tax rate is $0.311931 per $100 taxable value,

versus the 2025 rate of $0.276204 . While an increase was required to balance this budget, it

was partially offset with the 7% increase to the 14% homestead exemption. This offset

resulted in a net decrease in property taxes for residential homestead property (assuming

no change in other variables).

Sales tax has been a growing source of revenue for the City over the last several years. Sales

tax revenues help offset the amount of property tax revenue that is required for operations.

The City ’s sales tax remains strong. The budget includes sales for the General Fund at $5.3

million in revenue. When combined with the Colleyville Economic Development

Corporation ($2.65 million) and Colleyville Crime Control and Prevention District ($2.75

million), the total Colleyville sales tax revenue is $10.7 million.

User Fees and Charges

Customer water and wastewater rates are comprised of two components: base rate, or the

City ’s associated utility costs; and the volumetric rate, or the pass-through rate charged by

Trinity River Authority for actual consumption. For Fiscal Year 2026, Colleyville will

implement updated water and wastewater base rates to address the increasing operating

costs of the City's water distribution and wastewater collection system. These adjustments

are necessary to cover in|ationary costs, rising chemical costs, insurance, personnel, and

other essential operational expenses. The average residential user will see their base bill

increase by $1.67 per month. It is important to note that these changes apply to the base

rates, and the cost of water used is billed separately as a direct pass-through from the City ’s

water and wastewater service provider, Trinity River Authority (TRA).

In addition to the water rate adjustments, the City will increase the drainage utility rates to

support much-needed capital improvements. For residential properties, the drainage rate

will increase by $2 this year, from $12 to $14 per month. Non-residential properties will also

see an increase, though the speci{c amount will vary depending on the property. These

adjustments are necessary to fund essential drainage infrastructure projects and to ensure

the long-term sustainability of the City's drainage system.

Employee Staf{ng

FY 2025-2026 Annual Budget | Colleyville Page 11