Page 86 - FY 2021-22 ADOPTED BUDGET

P. 86

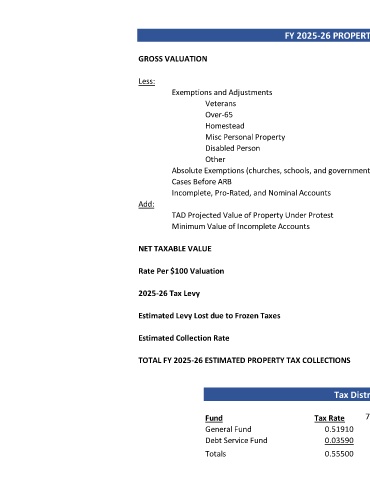

FY 2025-26 PROPERTY TAX CALCULATION

GROSS VALUATION $ 3,958,720,801

Less:

Exemptions and Adjustments

Veterans 61,681,797

Over-65 85,760,001

Homestead 29,969,997

Misc Personal Property 12,715,476

Disabled Person 257,500

Other 81,489

Absolute Exemptions (churches, schools, and government) 177,353,308

Cases Before ARB 42,033,266

Incomplete, Pro-Rated, and Nominal Accounts 6,757,301

Add:

TAD Projected Value of Property Under Protest 29,118,951

Minimum Value of Incomplete Accounts 4,180,920

NET TAXABLE VALUE $ 3,575,410,537

Rate Per $100 Valuation $ 0.55500

2025-26 Tax Levy $ 19,843,528

Estimated Levy Lost due to Frozen Taxes 991,007

Estimated Collection Rate 98%

TOTAL FY 2025-26 ESTIMATED PROPERTY TAX COLLECTIONS $ 18,475,471

Tax Distribution

Estimated

Fund Tax Rate 72 Percentage Levy

General Fund 0.51910 93.53% $ 17,280,391

Debt Service Fund 0.03590 6.47% 1,195,080

Totals 0.55500 100.00% $ 18,475,471