Page 130 - FY 2021-22 ADOPTED BUDGET

P. 130

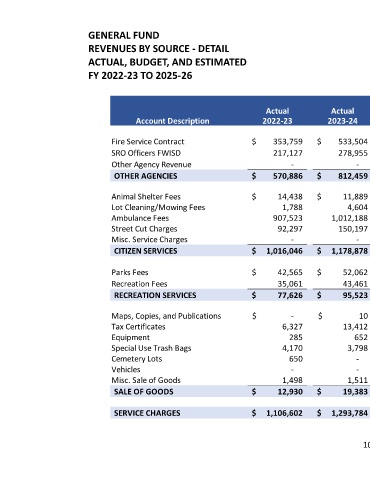

GENERAL FUND

REVENUES BY SOURCE - DETAIL

ACTUAL, BUDGET, AND ESTIMATED

FY 2022-23 TO 2025-26

Variance

Actual Actual Budget Estimated Favorable Budget

Account Description 2022-23 2023-24 2024-25 2024-25 (Unfavorable) 2025-26

Fire Service Contract $ 353,759 $ 533,504 $ 325,000 $ 325,000 $ - $ 325,000

SRO Officers FWISD 217,127 278,955 180,000 238,000 (38,000) 200,000

Other Agency Revenue - - - - - -

OTHER AGENCIES $ 570,886 $ 812,459 $ 505,000 $ 563,000 $ (38,000) $ 525,000

Animal Shelter Fees $ 14,438 $ 11,889 $ 12,000 $ 12,000 $ - $ 12,000

Lot Cleaning/Mowing Fees 1,788 4,604 - 3,000 - 3,000

Ambulance Fees 907,523 1,012,188 750,000 750,000 - 750,000

Street Cut Charges 92,297 150,197 100,000 100,000 - 100,000

Misc. Service Charges - - - - - -

CITIZEN SERVICES $ 1,016,046 $ 1,178,878 $ 862,000 $ 865,000 $ - $ 865,000

Parks Fees $ 42,565 $ 52,062 $ 30,000 $ 30,000 $ - $ 30,000

Recreation Fees 35,061 43,461 45,000 45,000 - 45,000

RECREATION SERVICES $ 77,626 $ 95,523 $ 75,000 $ 75,000 $ - $ 75,000

Maps, Copies, and Publications $ - $ 10 $ - $ 10 $ (10) $ -

Tax Certificates 6,327 13,412 5,000 7,500 - 7,500

Equipment 285 652 - 510 - -

Special Use Trash Bags 4,170 3,798 4,500 4,500 - 4,500

Cemetery Lots 650 - 500 250 - 250

Vehicles - - 10,000 105,000 (95,000) 10,000

Misc. Sale of Goods 1,498 1,511 1,500 1,000 - 1,000

SALE OF GOODS $ 12,930 $ 19,383 $ 21,500 $ 118,770 $ (95,010) $ 23,250

SERVICE CHARGES $ 1,106,602 $ 1,293,784 $ 958,500 $ 1,058,770 $ (95,520) $ 963,250

108