Page 126 - FY 2021-22 ADOPTED BUDGET

P. 126

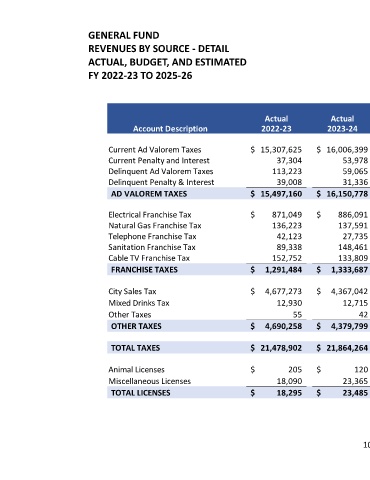

GENERAL FUND

REVENUES BY SOURCE - DETAIL

ACTUAL, BUDGET, AND ESTIMATED

FY 2022-23 TO 2025-26

Variance

Actual Actual Budget Estimated Favorable Budget

Account Description 2022-23 2023-24 2024-25 2024-25 (Unfavorable) 2025-26

Current Ad Valorem Taxes $ 15,307,625 $ 16,006,399 $ 17,371,654 $ 16,540,854 $ 739,537 $ 17,280,391

Current Penalty and Interest 37,304 53,978 30,000 45,000 (15,000) 30,000

Delinquent Ad Valorem Taxes 113,223 59,065 70,000 30,000 20,000 50,000

Delinquent Penalty & Interest 39,008 31,336 30,500 20,700 9,800 30,500

AD VALOREM TAXES $ 15,497,160 $ 16,150,778 $ 17,502,154 $ 16,636,554 $ 754,337 $ 17,390,891

Electrical Franchise Tax $ 871,049 $ 886,091 $ 850,000 $ 842,053 $ 7,947 $ 850,000

Natural Gas Franchise Tax 136,223 137,591 125,000 125,000 - 125,000

Telephone Franchise Tax 42,123 27,735 40,000 30,000 - 30,000

Sanitation Franchise Tax 89,338 148,461 100,000 100,000 - 100,000

Cable TV Franchise Tax 152,752 133,809 155,000 130,000 - 130,000

FRANCHISE TAXES $ 1,291,484 $ 1,333,687 $ 1,270,000 $ 1,227,053 $ 7,947 $ 1,235,000

City Sales Tax $ 4,677,273 $ 4,367,042 $ 4,500,000 $ 4,500,000 $ - $ 4,500,000

Mixed Drinks Tax 12,930 12,715 10,000 10,000 - 10,000

Other Taxes 55 42 - 100 (100) -

OTHER TAXES $ 4,690,258 $ 4,379,799 $ 4,510,000 $ 4,510,100 $ (100) $ 4,510,000

TOTAL TAXES $ 21,478,902 $ 21,864,264 $ 23,282,154 $ 22,373,707 $ 762,184 $ 23,135,891

Animal Licenses $ 205 $ 120 $ 300 $ 300 $ - $ 300

Miscellaneous Licenses 18,090 23,365 18,500 18,500 - 18,500

TOTAL LICENSES $ 18,295 $ 23,485 $ 18,800 $ 18,800 $ - $ 18,800

106