Page 5 - Bedford-FY25-26 Budget

P. 5

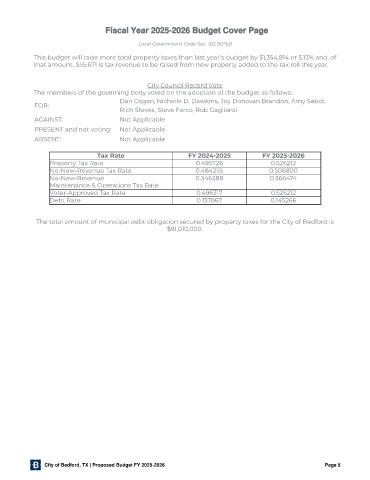

Fiscal Year 2025-2026 Budget Cover Page

Local Government Code Sec. 102.007(d)

This budget will raise more total property taxes than last year’s budget by $1,354,814 or 5.13% and, of

that amount, $55,671 is tax revenue to be raised from new property added to the tax roll this year.

City Council Record Vote

The members of the governing body voted on the adoption of the budget as follows:

Dan Cogan, Nichelle D. Dawkins, Joy Donovan Brandon, Amy Sabol,

FOR:

Rich Steves, Steve Farco, Rob Gagliardi

AGAINST: Not Applicable

PRESENT and not voting: Not Applicable

ABSENT: Not Applicable

Tax Rate FY 2024-2025 FY 2025-2026

Property Tax Rate 0.495726 0.526212

No-New-Revenue Tax Rate 0.484255 0.506800

No-New-Revenue 0.346388 0.366474

Maintenance & Operations Tax Rate

Voter-Approved Tax Rate 0.496317 0.526212

Debt Rate 0.137867 0.145266

The total amount of municipal debt obligation secured by property taxes for the City of Bedford is

$91,010,000.

City of Bedford, TX | Proposed Budget FY 2025-2026 Page 5