Page 9 - CityofArlingtonFY26AdoptedBudget

P. 9

Budget In Brief

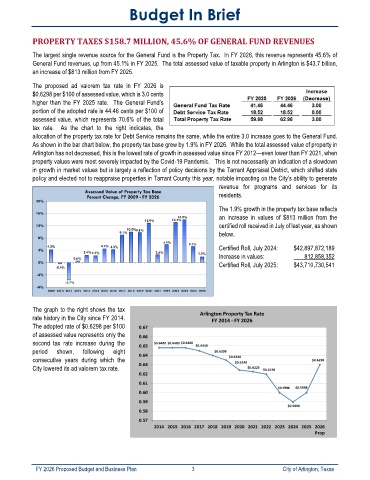

PROPERTY TAXES $158.7 MILLION, 45.6% OF GENERAL FUND REVENUES

The largest single revenue source for the General Fund is the Property Tax. In FY 2026, this revenue represents 45.6% of

General Fund revenues, up from 45.1% in FY 2025. The total assessed value of taxable property in Arlington is $43.7 billion,

an increase of $813 million from FY 2025.

The proposed ad valorem tax rate in FY 2026 is

$0.6298 per $100 of assessed value, which is 3.0 cents

higher than the FY 2025 rate. The General Fund’s

portion of the adopted rate is 44.46 cents per $100 of

assessed value, which represents 70.6% of the total

tax rate. As the chart to the right indicates, the

allocation of the property tax rate for Debt Service remains the same, while the entire 3.0 increase goes to the General Fund.

As shown in the bar chart below, the property tax base grew by 1.9% in FY 2026. While the total assessed value of property in

Arlington has not decreased, this is the lowest rate of growth in assessed value since FY 2012—even lower than FY 2021, when

property values were most severely impacted by the Covid-19 Pandemic. This is not necessarily an indication of a slowdown

in growth in market values but is largely a reflection of policy decisions by the Tarrant Appraisal District, which shifted state

policy and elected not to reappraise properties in Tarrant County this year, notable impacting on the City’s ability to generate

revenue for programs and services for its

residents.

The 1.9% growth in the property tax base reflects

an increase in values of $813 million from the

certified roll received in July of last year, as shown

below.

Certified Roll, July 2024: $42,897,872,189

Increase in values: 812,858,352

Certified Roll, July 2025: $43,710,730,541

The graph to the right shows the tax

rate history in the City since FY 2014.

The adopted rate of $0.6298 per $100

of assessed value represents only the

second tax rate increase during the

period shown, following eight

consecutive years during which the

City lowered its ad valorem tax rate.

FY 2026 Proposed Budget and Business Plan 3 City of Arlington, Texas