Page 15 - TownofWestlakeFY25BudgetOrd1005

P. 15

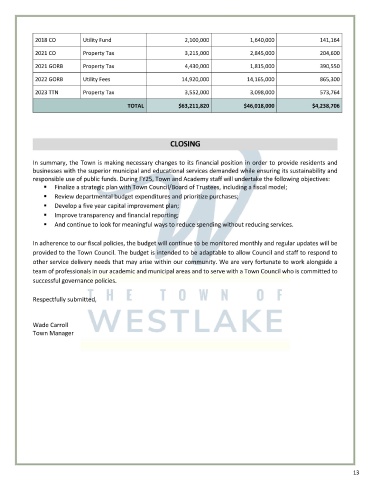

2018 CO Utility Fund 2,100,000 1,640,000 141,164

2021 CO Property Tax 3,215,000 2,845,000 204,600

2021 GORB Property Tax 4,430,000 1,815,000 390,550

2022 GORB Utility Fees 14,920,000 14,165,000 865,300

2023 TTN Property Tax 3,552,000 3,098,000 573,764

TOTAL $ 63,211,820 $ 46,018,000 $ 4,238,706

CLOSING

In summary, the Town is making necessary changes to its financial position in order to provide residents and

businesses with the superior municipal and educational services demanded while ensuring its sustainability and

responsible use of public funds. During FY25, Town and Academy staff will undertake the following objectives:

Finalize a strategic plan with Town Council/ Board of Trustees, including a fiscal model;

Review departmental budget expenditures and prioritize purchases;

Develop a five year capital improvement plan;

Improve transparency and financial reporting;

And continue to look for meaningful ways to reduce spending without reducing services.

In adherence to our fiscal policies, the budget will continue to be monitored monthly and regular updates will be

provided to the Town Council. The budget is intended to be adaptable to allow Council and staff to respond to

other service delivery needs that may arise within our community. We are very fortunate to work alongside a

team of professionals in our academic and municipal areas and to serve with a Town Council who is committed to

successful governance policies.

Respectfully submitted,

Wade Carroll

Town Manager

13