Page 123 - TownofTrophyClubOrd202533FY25BudgetAmendment

P. 123

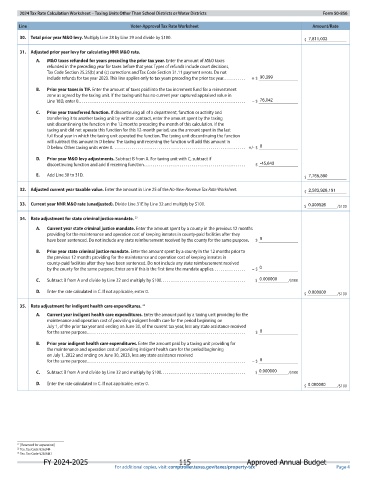

2024 Tax Rate Calculation Notice

Town of Trophy Club

Taxing Unit Name: _____________________________ Attached are

the following documents:

No New Revenue and Voter Approval Tax Rate Worksheets

Notice of Tax Rates (required to be posted on taxing unit website)

Approving Rates: Section 8 on worksheet shows the following rates

No New Revenue Rate

Voter Approval Rate

Di Minimis Rate (if applicable)

Please review these documents carefully and notify our office of any changes that need to be made. If any

changes are made, our office will send out new documents including the revisions. Once you are satisfied that

the calculation is correct, please sign this document stating that you approve the calculation worksheet that is

attached to this document.

0.316042

Proposed M&O_______________ (Maintenance & Operation Rate)

0.099427

Proposed I&S_________________ (Interest & Sinking or Debt Rate)

(proposed I&S rate must match line 48 on worksheet)

0.415469

Proposed Total Rate___________

Town of Trophy Club

As a representative of _______________________, I approve the Tax Rate Calculation and have provided the

proposed tax rate for the taxing entity listed above.

April Duvall

_______________________________

Printed name

8/12/2024

________________________________ ____________

Signature Date

FY 2024-2025 111 Approved Annual Budget