Page 122 - TownofTrophyClubOrd202533FY25BudgetAmendment

P. 122

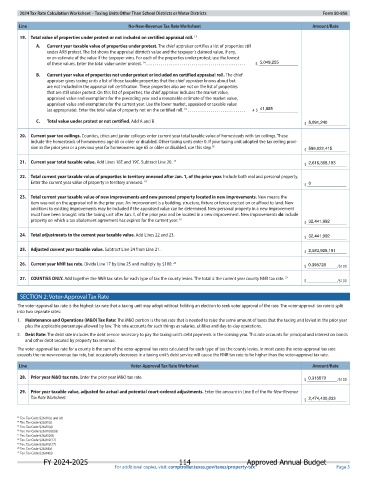

FLEET # 474 New Request Approved By Finance

CAPITAL EQUIPMENT ITEM 2024 Chevy 3500

DEPARTMENT COMMUNITY DEVELOPMENT DIVISION

CATEGORY VEHICLE

VEHICLE INFORMATION

MANUFACTURER: Chevrolet

MODEL: 3500

PURCHASE INFORMATION

ACQUIRED DATE 10/1/2024

PURCHASE PRICE $78,000.00

END OF LIFE DATE 10/1/2031

BUDGET INFORMATION

YEARS OF LIFE 7

YEARLY INFLATIONARY FACTOR $2,340.00 Investment Decision

YEARLY TRANSFER $13,482.86

FUNDING TIMELINE

2024 2025 2026 2027 2028 2029

COMMUNITY DEVELOPMENT EQUIPMENT REPALCEMENT FUND

$0.00 $78,000.00 $0.00 $0.00 $0.00 $0.00

$0.00 $0.00 $0.00 $0.00 $0.00 $0.00

TOTAL

$0.00 $78,000.00 $0.00 $0.00 $0.00 $0.00

DESCRIPTION JUSTIFICATION

2024 Chevrolet 3500 Replacing our only 1‐ton vehicle, which often goes in for

repairs due to age and mileage. This limits our capabilities and

forces us to use a smaller truck. Extra funds are included for

outfitting the new truck with a rack and lights.

FY 2024-2025 110 Approved Annual Budget