Page 26 - CityofSouthlakeFY25AdoptedBudget

P. 26

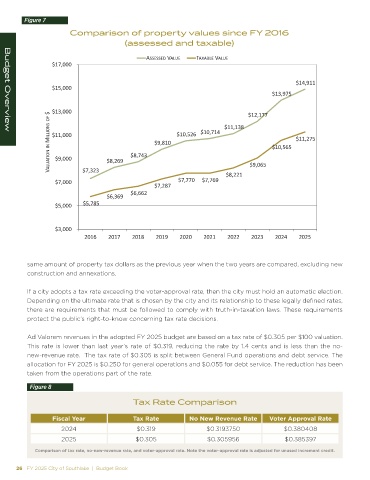

Figure 7

Comparison of property values since FY 2016

(assessed and taxable)

^^ ^^ s >h d y > s >h

Ψϭϳ͕ϬϬϬ

Ψϭϰ͕ϵϭϭ

Ψϭϱ͕ϬϬϬ

Ψϭϯ͕ϵϳϱ

Ψϭϯ͕ϬϬϬ

Ψ ΨϭϮ͕ϭϳϳ

K&

D/>>/KE^ Ψϭϭ͕ϬϬϬ ΨϭϬ͕ϱϮϲ ΨϭϬ͕ϳϭϰ Ψϭϭ͕ϭϯϴ Ψϭϭ͕Ϯϳϱ

Budget Overview

/E Ψϴ͕ϳϰϯ Ψϵ͕ϴϭϬ ΨϭϬ͕ϱϲϱ

s >h d/KE Ψϵ͕ϬϬϬ Ψϳ͕ϯϮϯ Ψϴ͕Ϯϲϵ Ψϵ͕Ϭϲϱ

Ψϳ͕ϬϬϬ Ψϳ͕ϳϳϬ Ψϳ͕ϳϲϵ Ψϴ͕ϮϮϭ

Ψϳ͕Ϯϴϳ

Ψϲ͕ϯϲϵ Ψϲ͕ϲϲϮ

Ψϱ͕ϬϬϬ Ψϱ͕ϳϴϱ

Ψϯ͕ϬϬϬ

ϮϬϭϲ ϮϬϭϳ ϮϬϭϴ ϮϬϭϵ ϮϬϮϬ ϮϬϮϭ ϮϬϮϮ ϮϬϮϯ ϮϬϮϰ ϮϬϮϱ

same amount of property tax dollars as the previous year when the two years are compared, excluding new

construction and annexations.

If a city adopts a tax rate exceeding the voter-approval rate, then the city must hold an automatic election.

Depending on the ultimate rate that is chosen by the city and its relationship to these legally defined rates,

there are requirements that must be followed to comply with truth-in-taxation laws. These requirements

protect the public’s right-to-know concerning tax rate decisions.

Ad Valorem revenues in the adopted FY 2025 budget are based on a tax rate of $0.305 per $100 valuation.

This rate is lower than last year’s rate of $0.319, reducing the rate by 1.4 cents and is less than the no-

new-revenue rate. The tax rate of $0.305 is split between General Fund operations and debt service. The

allocation for FY 2025 is $0.250 for general operations and $0.055 for debt service. The reduction has been

taken from the operations part of the rate.

Figure 8

Tax Rate Comparison

Fiscal Year Tax Rate No New Revenue Rate Voter Approval Rate

2024 $0.319 $0.3193750 $0.380408

2025 $0.305 $0.305956 $0.385397

Comparison of tax rate, no-new-revenue rate, and voter-approval rate. Note the voter-approval rate is adjusted for unused increment credit.

26 FY 2025 City of Southlake | Budget Book