Page 24 - CityofSouthlakeFY25AdoptedBudget

P. 24

Budget Overview

The City’s budget is made up of specific funds to account for the revenue and expenditures that support

operations. Funds also account for debt incurred for capital improvements. There are funds supported

by tax revenue, while others are supported by fees that have been put into place to cover the cost of the

service. Some funds are restricted for specific purposes, while others offer more spending flexibility.

This overview is organized to first provide an analysis of the comprehensive budget, providing an overview

of revenue and expenditures across all funds along with a multi-year forecast that incorporates the impact

of FY 2025 Adopted Operating Budget and includes any anticipated changes to revenues or expenditures

within the multi-year window. Following that, each fund will be highlighted, noting key aspects for each as

well as identifying strategic investments that each fund provides.

Revenues – Total Operating Resources

Budget Overview

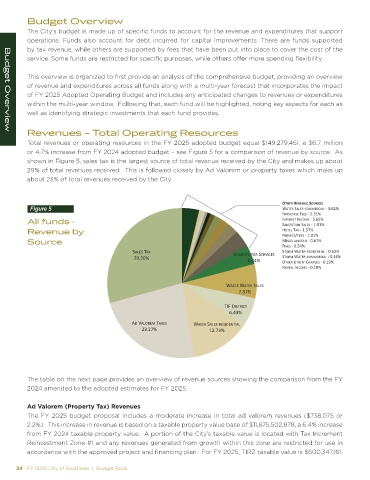

Total revenues or operating resources in the FY 2025 adopted budget equal $149,279,451, a $6.7 million

or 4.7% increase from FY 2024 adopted budget – see Figure 5 for a comparison of revenue by source. As

shown in Figure 5, sales tax is the largest source of total revenue received by the City and makes up about

29% of total revenues received. This is followed closely by Ad Valorem or property taxes which make up

about 23% of total revenues received by the City.

Kd, Z Z s Eh ^KhZ ^

Figure 5 t d Z ^ > ^Ͳ KDD Z / > Ͳ ϯ͘ϲϮй

&Z E ,/^ & ^ Ͳ Ϯ͘ϯϭй

All funds - /Ed Z ^d /E KD Ͳ ϯ͘ϲϱй

^ E/d d/KE ^ > ^ Ͳ ϭ͘ϵϭй

Revenue by ,Kd > d y Ͳ ϭ͘ϱϳй

W ZD/d^ͬ& ^ Ͳ ϭ͘Ϭϭй

Source D/^ >> E Kh^ Ͳ Ϭ͘ϲϳй

&/E ^ Ͳ Ϭ͘ϱϰй

^ > ^ d y , Z' ^ &KZ ^ Zs/ ^ ^dKZD t d ZͲZ ^/ Ed/ > Ͳ Ϭ͘ϲϮй

Ϯϵ͘ϯϬй ^dKZD t d ZͲ KDD Z / > Ͳ Ϭ͘ϰϲй

ϰ͘Ϯϰй Kd, Z hd/>/dz , Z' ^ Ͳ Ϭ͘ϭϵй

Z Ed > /E KD Ͳ Ϭ͘ϭϬй

t ^d t d Z ^ > ^

ϳ͘ϯϳй

d/& /^dZ/ d

ϲ͘ϰϯй

s >KZ D d y ^ t d Z ^ > ^ͲZ ^/ Ed/ >

Ϯϯ͘Ϯϳй ϭϮ͘ϳϯй

The table on the next page provides an overview of revenue sources showing the comparison from the FY

2024 amended to the adopted estimates for FY 2025.

Ad Valorem (Property Tax) Revenues

The FY 2025 budget proposal includes a moderate increase in total ad valorem revenues ($738,075 or

2.2%). This increase in revenue is based on a taxable property value base of $11,875,502,878, a 6.4% increase

from FY 2024 taxable property value. A portion of the City’s taxable value is located with Tax Increment

Reinvestment Zone #1 and any revenues generated from growth within this zone are restricted for use in

accordance with the approved project and financing plan. For FY 2025, TIRZ taxable value is $600,347,161.

24 FY 2025 City of Southlake | Budget Book