Page 255 - CityofSaginawFY25Budget

P. 255

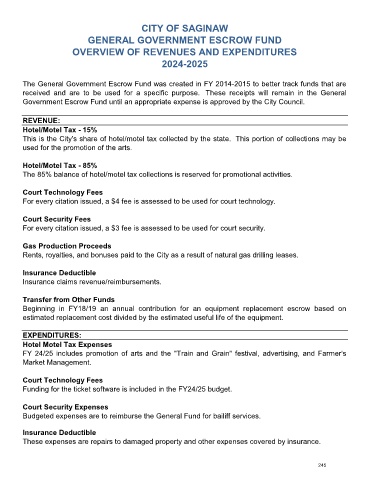

CITY OF SAGINAW

GENERAL GOVERNMENT ESCROW FUND

OVERVIEW OF REVENUES AND EXPENDITURES

2024-2025

The General Government Escrow Fund was created in FY 2014-2015 to better track funds that are

received and are to be used for a specific purpose. These receipts will remain in the General

Government Escrow Fund until an appropriate expense is approved by the City Council.

REVENUE:

Hotel/Motel Tax - 15%

This is the City's share of hotel/motel tax collected by the state. This portion of collections may be

used for the promotion of the arts.

Hotel/Motel Tax - 85%

The 85% balance of hotel/motel tax collections is reserved for promotional activities.

Court Technology Fees

For every citation issued, a $4 fee is assessed to be used for court technology.

Court Security Fees

For every citation issued, a $3 fee is assessed to be used for court security.

Gas Production Proceeds

Rents, royalties, and bonuses paid to the City as a result of natural gas drilling leases.

Insurance Deductible

Insurance claims revenue/reimbursements.

Transfer from Other Funds

Beginning in FY18/19 an annual contribution for an equipment replacement escrow based on

estimated replacement cost divided by the estimated useful life of the equipment.

EXPENDITURES:

Hotel Motel Tax Expenses

FY 24/25 includes promotion of arts and the "Train and Grain" festival, advertising, and Farmer's

Market Management.

Court Technology Fees

Funding for the ticket software is included in the FY24/25 budget.

Court Security Expenses

Budgeted expenses are to reimburse the General Fund for bailiff services.

Insurance Deductible

These expenses are repairs to damaged property and other expenses covered by insurance.

245