Page 121 - CityofKennedaleFY25AdoptedBudget

P. 121

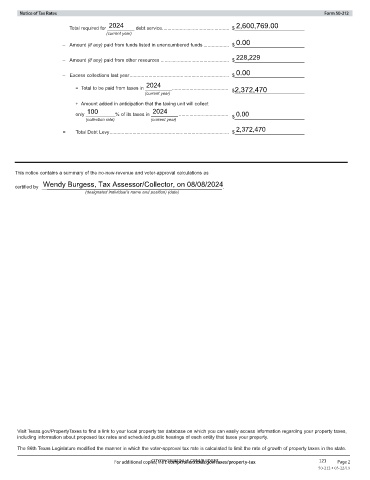

2024 2,600,769.00

Total required for __________ debt service .................................................. $__________________________

(current year)

0.00

– Amount (if any) paid from funds listed in unencumbered funds ................... $__________________________

228,229

– Amount (if any) paid from other resources ................................................... $__________________________

0.00

– Excess collections last year .......................................................................... $__________________________

2024

= Total to be paid from taxes in __________ .......................................... $__________________________

2,372,470

(current year)

+ Amount added in anticipation that the taxing unit will collect

100 2024

0.00

only ___________% of its taxes in __________ ..................................... $__________________________

(collection rate) (current year)

2,372,470

= Total Debt Levy ......................................................................................... $__________________________

This notice contains a summary of the no-new-revenue and voter-approval calculations as

Wendy Burgess, Tax Assessor/Collector, on 08/08/2024

certified by ___________________________________________________________________ .

(designated individual’s name and position) (date)

Visit Texas.gov/PropertyTaxes to find a link to your local property tax database on which you can easily access information regarding your property taxes,

including information about proposed tax rates and scheduled public hearings of each entity that taxes your property.

The 86th Texas Legislature modified the manner in which the voter-approval tax rate is calculated to limit the rate of growth of property taxes in the state.

CITYOFKENNEDALE.COM/BUDGET 121