Page 369 - CityofKellerFY25Budget

P. 369

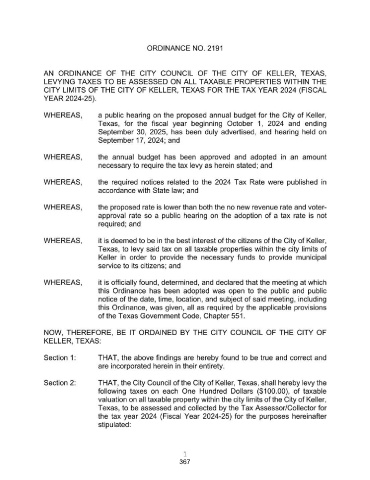

ORDINANCE NO. 2191

AN ORDINANCE OF THE CITY COUNCIL OF THE CITY OF KELLER, TEXAS,

LEVYING TAXES TO BE ASSESSED ON ALL TAXABLE PROPERTIES WITHIN THE

CITY LIMITS OF THE CITY OF KELLER, TEXAS FOR THE TAX YEAR 2024 (FISCAL

YEAR 2024-25).

WHEREAS, a public hearing on the proposed annual budget for the City of Keller,

Texas, for the fiscal year beginning October 1, 2024 and ending

September 30, 2025, has been duly advertised, and hearing held on

September 17, 2024; and

WHEREAS, the annual budget has been approved and adopted in an amount

necessary to require the tax levy as herein stated; and

WHEREAS, the required notices related to the 2024 Tax Rate were published in

accordance with State law; and

WHEREAS, the proposed rate is lower than both the no new revenue rate and voter-

approval rate so a public hearing on the adoption of a tax rate is not

required; and

WHEREAS, it is deemed to be in the best interest of the citizens of the City of Keller,

Texas, to levy said tax on all taxable properties within the city limits of

Keller in order to provide the necessary funds to provide municipal

service to its citizens; and

WHEREAS, it is officially found, determined, and declared that the meeting at which

this Ordinance has been adopted was open to the public and public

notice of the date, time, location, and subject of said meeting, including

this Ordinance, was given, all as required by the applicable provisions

of the Texas Government Code, Chapter 551.

NOW, THEREFORE, BE IT ORDAINED BY THE CITY COUNCIL OF THE CITY OF

KELLER, TEXAS:

Section 1: THAT, the above findings are hereby found to be true and correct and

are incorporated herein in their entirety.

Section 2: THAT, the City Council of the City of Keller, Texas, shall hereby levy the

following taxes on each One Hundred Dollars ($ 100.00), of taxable

valuation on all taxable property within the city limits of the City of Keller,

Texas, to be assessed and collected by the Tax Assessor/Collector for

the tax year 2024 (Fiscal Year 2024-25) for the purposes hereinafter

stipulated:

1

367