Page 259 - CityofKellerFY25Budget

P. 259

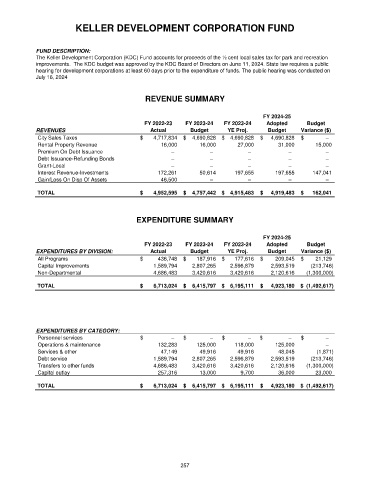

KELLER DEVELOPMENT CORPORATION FUND

FUND DESCRIPTION:

The Keller Development Corporation (KDC) Fund accounts for proceeds of the ½ cent local sales tax for park and recreation

improvements. The KDC budget was approved by the KDC Board of Directors on June 11, 2024. State law requires a public

hearing for development corporations at least 60 days prior to the expenditure of funds. The public hearing was conducted on

July 16, 2024

REVENUE SUMMARY

FY 2024-25

FY 2022-23 FY 2023-24 FY 2023-24 Adopted Budget

REVENUES Actual Budget YE Proj. Budget Variance ($)

City Sales Taxes $ 4,717,834 $ 4,690,828 $ 4,690,828 $ 4,690,828 $ –

Rental Property Revenue 16,000 16,000 27,000 31,000 15,000

Premium On Debt Issuance – – – – –

Debt Issuance-Refunding Bonds – – – – –

Grant-Local – – – – –

Interest Revenue-Investments 172,261 50,614 197,655 197,655 147,041

Gain/Loss On Disp Of Assets 46,500 – – – –

TOTAL $ 4,952,595 $ 4,757,442 $ 4,915,483 $ 4,919,483 $ 162,041

EXPENDITURE SUMMARY

FY 2024-25

FY 2022-23 FY 2023-24 FY 2023-24 Adopted Budget

EXPENDITURES BY DIVISION: Actual Budget YE Proj. Budget Variance ($)

All Programs $ 436,748 $ 187,916 $ 177,616 $ 209,045 $ 21,129

Capital Improvements 1,589,794 2,807,265 2,596,879 2,593,519 (213,746)

Non-Departmental 4,686,483 3,420,616 3,420,616 2,120,616 (1,300,000)

TOTAL $ 6,713,024 $ 6,415,797 $ 6,195,111 $ 4,923,180 $ (1,492,617)

EXPENDITURES BY CATEGORY:

Personnel services $ – $ – $ – $ – $ –

Operations & maintenance 132,283 125,000 118,000 125,000 –

Services & other 47,149 49,916 49,916 48,045 (1,871)

Debt service 1,589,794 2,807,265 2,596,879 2,593,519 (213,746)

Transfers to other funds 4,686,483 3,420,616 3,420,616 2,120,616 (1,300,000)

Capital outlay 257,316 13,000 9,700 36,000 23,000

TOTAL $ 6,713,024 $ 6,415,797 $ 6,195,111 $ 4,923,180 $ (1,492,617)

257