Page 125 - CityofKellerFY25Budget

P. 125

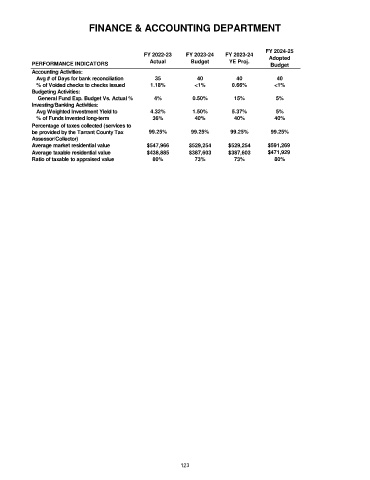

FINANCE & ACCOUNTING DEPARTMENT

FY 2024-25

FY 2022-23 FY 2023-24 FY 2023-24 Adopted

PERFORMANCE INDICATORS Actual Budget YE Proj. Budget

Accounting Activities:

Avg # of Days for bank reconciliation 35 40 40 40

% of Voided checks to checks issued 1.18% <1% 0.66% <1%

Budgeting Activities:

General Fund Exp. Budget Vs. Actual % 4% 0.50% 15% 5%

Investing/Banking Activities:

Avg Weighted Investment Yield to 4.32% 1.50% 5.37% 5%

% of Funds invested long-term 36% 40% 40% 40%

Percentage of taxes collected (services to

be provided by the Tarrant County Tax 99.25% 99.25% 99.25% 99.25%

Assessor/Collector)

Average market residential value $547,966 $529,254 $529,254 $591,269

Average taxable residential value $438,885 $387,603 $387,603 $471,929

Ratio of taxable to appraised value 80% 73% 73% 80%

123