Page 36 - HaltomCityFY25Budget

P. 36

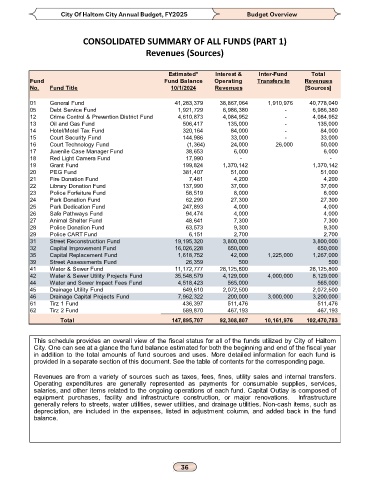

City Of Haltom City Annual Budget, FY2025 Budget Overview

CONSOLIDATED SUMMARY OF ALL FUNDS (PART 1)

Revenues (Sources)

Estimated* Interest & Inter-Fund Total

Fund Fund Balance Operating Transfers In Revenues

No. Fund Title 10/1/2024 Revenues [Sources]

01 General Fund 41,283,379 38,867,064 1,910,976 40,778,040

05 Debt Service Fund 1,921,729 6,986,380 - 6,986,380

12 Crime Control & Prevention District Fund 4,610,873 4,084,952 - 4,084,952

13 Oil and Gas Fund 506,417 135,000 - 135,000

14 Hotel/Motel Tax Fund 320,164 84,000 - 84,000

15 Court Security Fund 144,986 33,000 - 33,000

16 Court Technology Fund (1,364) 24,000 26,000 50,000

17 Juvenile Case Manager Fund 38,653 6,000 6,000

18 Red Light Camera Fund 17,990 - -

19 Grant Fund 199,824 1,370,142 1,370,142

20 PEG Fund 381,407 51,000 51,000

21 Fire Donation Fund 7,481 4,200 4,200

22 Library Donation Fund 137,990 37,000 37,000

23 Police Forfeiture Fund 58,519 8,000 8,000

24 Park Donation Fund 62,290 27,300 27,300

25 Park Dedication Fund 247,893 4,000 4,000

26 Safe Pathways Fund 94,474 4,000 4,000

27 Animal Shelter Fund 48,641 7,300 7,300

28 Police Donation Fund 63,573 9,300 9,300

29 Police CART Fund 6,151 2,700 2,700

31 Street Reconstruction Fund 19,195,320 3,800,000 3,800,000

32 Capital Improvement Fund 16,026,228 650,000 650,000

35 Capital Replacement Fund 1,618,752 42,000 1,225,000 1,267,000

39 Street Assessments Fund 26,359 500 500

41 Water & Sewer Fund 11,172,777 28,125,800 28,125,800

42 Water & Sewer Utility Projects Fund 35,548,579 4,129,000 4,000,000 8,129,000

44 Water and Sewer Impact Fees Fund 4,518,423 565,000 565,000

45 Drainage Utility Fund 649,610 2,072,500 2,072,500

46 Drainage Capital Projects Fund 7,962,322 200,000 3,000,000 3,200,000

61 Tirz 1 Fund 436,397 511,476 511,476

62 Tirz 2 Fund 589,870 467,193 467,193

Total 147,895,707 92,308,807 10,161,976 102,470,783

This schedule provides an overall view of the fiscal status for all of the funds utilized by City of Haltom

City. One can see at a glance the fund balance estimated for both the beginning and end of the fiscal year

in addition to the total amounts of fund sources and uses. More detailed information for each fund is

provided in a separate section of this document. See the table of contents for the corresponding page.

Revenues are from a variety of sources such as taxes, fees, fines, utility sales and internal transfers.

Operating expenditures are generally represented as payments for consumable supplies, services,

salaries, and other items related to the ongoing operations of each fund. Capital Outlay is composed of

equipment purchases, facility and infrastructure construction, or major renovations. Infrastructure

generally refers to streets, water utilities, sewer utilities, and drainage utilities. Non-cash items, such as

depreciation, are included in the expenses, listed in adjustment column, and added back in the fund

balance.