Page 56 - CityofGrapevineFY25AdoptedBudget

P. 56

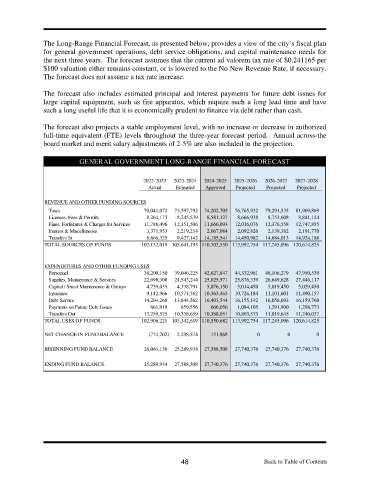

The Long-Range Financial Forecast, as presented below, provides a view of the city’s fiscal plan

for general government operations, debt service obligations, and capital maintenance needs for

the next three years. The forecast assumes that the current ad valorem tax rate of $0.241165 per

$100 valuation either remains constant, or is lowered to the No New Revenue Rate, if necessary.

The forecast does not assume a tax rate increase.

The forecast also includes estimated principal and interest payments for future debt issues for

large capital equipment, such as fire apparatus, which require such a long lead time and have

such a long useful life that it is economically prudent to finance via debt rather than cash.

The forecast also projects a stable employment level, with no increase or decrease in authorized

full-time equivalent (FTE) levels throughout the three-year forecast period. Annual across-the

board market and merit salary adjustments of 2-5% are also included in the projection.

GENERAL GOVERNMENT LONG-RANGE FINANCIAL FORECAST

2022-2023 2023-2024 2024-2025 2025-2026 2026-2027 2027-2028

Actual Estimated Approved Projected Projected Projected

REVENUE AND OTHER FUNDING SOURCES

Taxes 70,041,072 73,597,792 74,202,705 76,765,932 79,291,535 81,909,869

Licenses, Fees & Permits 8,264,173 8,245,539 8,581,127 8,666,938 8,753,608 8,841,144

Fines, Forfeitures & Charges for Services 11,788,496 12,151,506 11,666,093 12,016,076 12,376,558 12,747,855

Interest & Miscellaneous 3,371,953 2,219,214 2,067,084 2,092,826 2,139,382 2,191,770

Transfers In 8,666,325 9,427,142 14,185,541 14,450,982 14,684,013 14,924,188

TOTAL SOURCES OF FUNDS 102,132,019 105,641,193 110,702,550 113,992,754 117,245,096 120,614,825

EXPENDITURES AND OTHER FUNDING USES

Personnel 38,200,150 39,046,225 42,627,847 44,332,961 46,106,279 47,950,530

Supplies, Maintenance & Services 22,698,308 24,543,244 25,025,571 25,876,339 26,649,628 27,446,117

Capital / Street Maintenance & Outlays 4,739,035 4,338,791 5,076,150 5,014,450 5,019,450 5,029,450

Insurance 9,142,966 10,571,582 10,363,463 10,726,184 11,101,601 11,490,157

Debt Service 14,204,268 13,844,562 16,403,544 16,155,142 16,056,693 16,159,760

Payments on Future Debt Issues 661,919 659,556 666,056 1,084,105 1,291,800 1,298,773

Transfers Out 13,259,575 10,338,659 10,388,051 10,803,573 11,019,645 11,240,037

TOTAL USES OF FUNDS 102,906,221 103,342,619 110,550,682 113,992,754 117,245,096 120,614,825

NET CHANGE IN FUND BALANCE (774,202) 2,298,574 151,868 0 0 0

BEGINNING FUND BALANCE 26,064,136 25,289,934 27,588,508 27,740,376 27,740,376 27,740,376

ENDING FUND BALANCE 25,289,934 27,588,508 27,740,376 27,740,376 27,740,376 27,740,376

48 Back to Table of Contents

of

of

Contents

Contents

Table

Back

Back

to

Table

to