Page 45 - CityofGrapevineFY25AdoptedBudget

P. 45

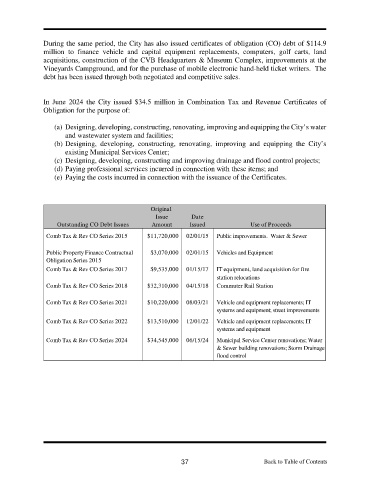

During the same period, the City has also issued certificates of obligation (CO) debt of $114.9

million to finance vehicle and capital equipment replacements, computers, golf carts, land

acquisitions, construction of the CVB Headquarters & Museum Complex, improvements at the

Vineyards Campground, and for the purchase of mobile electronic hand-held ticket writers. The

debt has been issued through both negotiated and competitive sales.

In June 2024 the City issued $34.5 million in Combination Tax and Revenue Certificates of

Obligation for the purpose of:

(a) Designing, developing, constructing, renovating, improving and equipping the City’s water

and wastewater system and facilities;

(b) Designing, developing, constructing, renovating, improving and equipping the City’s

existing Municipal Services Center;

(c) Designing, developing, constructing and improving drainage and flood control projects;

(d) Paying professional services incurred in connection with these items; and

(e) Paying the costs incurred in connection with the issuance of the Certificates.

Original

Issue Date

Outstanding CO Debt Issues Amount Issued Use of Proceeds

Comb Tax & Rev CO Series 2015 $11,720,000 02/01/15 Public improvements. Water & Sewer

Public Property Finance Contractual $3,070,000 02/01/15 Vehicles and Equipment

Obligation Series 2015

Comb Tax & Rev CO Series 2017 $9,535,000 01/15/17 IT equipment, land acquisition for fire

station relocations

Comb Tax & Rev CO Series 2018 $32,310,000 04/15/18 Commuter Rail Station

Comb Tax & Rev CO Series 2021 $10,220,000 08/03/21 Vehicle and equipment replacements; IT

systems and equipment; street improvements

Comb Tax & Rev CO Series 2022 $13,510,000 12/01/22 Vehicle and equipment replacements; IT

systems and equipment

Comb Tax & Rev CO Series 2024 $34,545,000 06/15/24 Municipal Service Center renovations; Water

& Sewer building renovations; Storm Drainage

flood control

37 Back to Table of Contents

Back to Table of Contents