Page 96 - City of Fort Worth Budget Book

P. 96

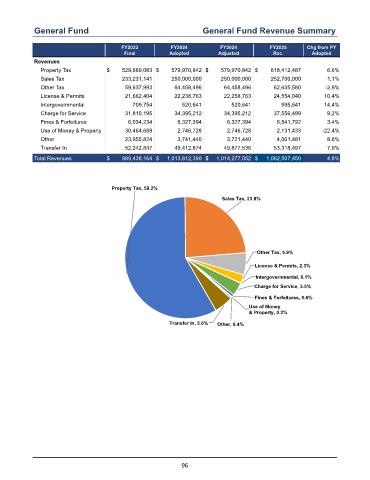

General Fund General Fund Revenue Summary

FY2023 FY2024 FY2024 FY2025 Chg from PY

Final Adopted Adjusted Rec. Adopted

Revenues

Property Tax $ 529,689,083 $ 579,970,842 $ 579,970,842 $ 618,412,487 6.6 %

Sales Tax 233,231,141 250,000,000 250,000,000 252,700,000 1.1 %

Other Tax 59,637,993 64,458,496 64,458,496 62,635,580 -2.8 %

License & Permits 21,662,404 22,238,763 22,258,763 24,554,040 10.4 %

Intergovernmental 709,754 520,641 520,641 595,641 14.4 %

Charge for Service 31,810,195 34,395,212 34,395,212 37,556,499 9.2 %

Fines & Forfeitures 6,034,234 6,327,394 6,327,394 6,541,792 3.4 %

Use of Money & Property 30,464,689 2,746,728 2,746,728 2,131,433 -22.4 %

Other 23,955,824 3,741,440 3,721,440 4,061,481 8.6 %

Transfer In 52,242,847 49,412,874 49,877,536 53,318,497 7.9 %

Total Revenues $ 989,438,164 $ 1,013,812,390 $ 1,014,277,052 $ 1,062,507,450 4.8 %

Property Tax, 58.2%

Sales Tax, 23.8%

Other Tax, 5.9%

License & Permits, 2.3%

Intergovernmental, 0.1%

Charge for Service, 3.5%

Fines & Forfeitures, 0.6%

Use of Money

& Property, 0.2%

Transfer In, 5.0% Other, 0.4%

96