Page 257 - City of Fort Worth Budget Book

P. 257

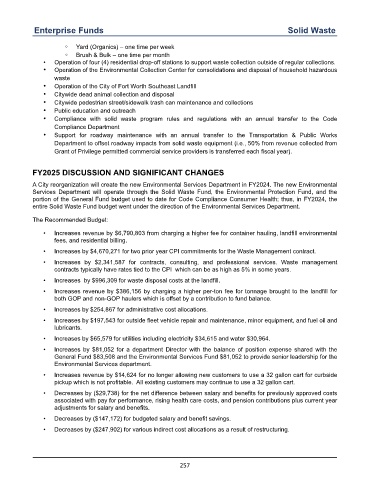

Enterprise Funds Solid Waste

◦ Yard (Organics) – one time per week

◦ Brush & Bulk – one time per month

• Operation of four (4) residential drop-off stations to support waste collection outside of regular collections.

• Operation of the Environmental Collection Center for consolidations and disposal of household hazardous

waste

• Operation of the City of Fort Worth Southeast Landfill

• Citywide dead animal collection and disposal

• Citywide pedestrian street/sidewalk trash can maintenance and collections

• Public education and outreach

• Compliance with solid waste program rules and regulations with an annual transfer to the Code

Compliance Department

• Support for roadway maintenance with an annual transfer to the Transportation & Public Works

Department to offset roadway impacts from solid waste equipment (i.e., 50% from revenue collected from

Grant of Privilege permitted commercial service providers is transferred each fiscal year).

FY2025 DISCUSSION AND SIGNIFICANT CHANGES

A City reorganization will create the new Environmental Services Department in FY2024. The new Environmental

Services Department will operate through the Solid Waste Fund, the Environmental Protection Fund, and the

portion of the General Fund budget used to date for Code Compliance Consumer Health; thus, in FY2024, the

entire Solid Waste Fund budget went under the direction of the Environmental Services Department.

The Recommended Budget:

• Increases revenue by $6,790,803 from charging a higher fee for container hauling, landfill environmental

fees, and residential billing.

• Increases by $4,670,271 for two prior year CPI commitments for the Waste Management contract.

• Increases by $2,341,587 for contracts, consulting, and professional services. Waste management

contracts typically have rates tied to the CPI which can be as high as 5% in some years.

• Increases by $996,309 for waste disposal costs at the landfill.

• Increases revenue by $386,156 by charging a higher per-ton fee for tonnage brought to the landfill for

both GOP and non-GOP haulers which is offset by a contribution to fund balance.

• Increases by $254,867 for administrative cost allocations.

• Increases by $197,543 for outside fleet vehicle repair and maintenance, minor equipment, and fuel oil and

lubricants.

• Increases by $65,579 for utilities including electricity $34,615 and water $30,964.

• Increases by $81,052 for a department Director with the balance of position expense shared with the

General Fund $83,508 and the Environmental Services Fund $81,052 to provide senior leadership for the

Environmental Services department.

• Increases revenue by $14,624 for no longer allowing new customers to use a 32 gallon cart for curbside

pickup which is not profitable. All existing customers may continue to use a 32 gallon cart.

• Decreases by ($29,738) for the net difference between salary and benefits for previously approved costs

associated with pay for performance, rising health care costs, and pension contributions plus current year

adjustments for salary and benefits.

• Decreases by ($147,172) for budgeted salary and benefit savings.

• Decreases by ($247,902) for various indirect cost allocations as a result of restructuring.

257