Page 235 - City of Fort Worth Budget Book

P. 235

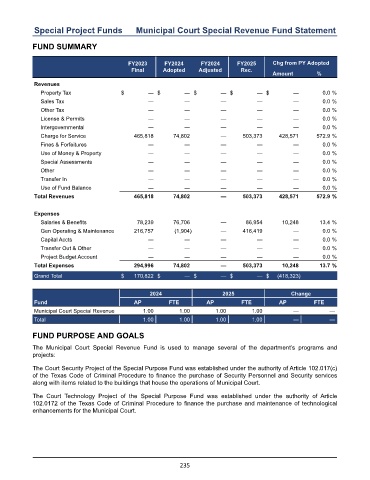

Special Project Funds Municipal Court Special Revenue Fund Statement

FUND SUMMARY

FY2023 FY2024 FY2024 FY2025 Chg from PY Adopted

Final Adopted Adjusted Rec.

Amount %

Revenues

Property Tax $ — $ — $ — $ — $ — 0.0 %

Sales Tax — — — — — 0.0 %

Other Tax — — — — — 0.0 %

License & Permits — — — — — 0.0 %

Intergovernmental — — — — — 0.0 %

Charge for Service 465,818 74,802 — 503,373 428,571 572.9 %

Fines & Forfeitures — — — — — 0.0 %

Use of Money & Property — — — — — 0.0 %

Special Assessments — — — — — 0.0 %

Other — — — — — 0.0 %

Transfer In — — — — — 0.0 %

Use of Fund Balance — — — — — 0.0 %

Total Revenues 465,818 74,802 — 503,373 428,571 572.9 %

Expenses

Salaries & Benefits 78,239 76,706 — 86,954 10,248 13.4 %

Gen Operating & Maintenance 216,757 (1,904) — 416,419 — 0.0 %

Capital Accts — — — — — 0.0 %

Transfer Out & Other — — — — — 0.0 %

Project Budget Account — — — — — 0.0 %

Total Expenses 294,996 74,802 — 503,373 10,248 13.7 %

Grand Total $ 170,822 $ — $ — $ — $ (418,323)

2024 2025 Change

Fund AP FTE AP FTE AP FTE

Municipal Court Special Revenue 1.00 1.00 1.00 1.00 — —

Total 1.00 1.00 1.00 1.00 — —

FUND PURPOSE AND GOALS

The Municipal Court Special Revenue Fund is used to manage several of the department’s programs and

projects:

The Court Security Project of the Special Purpose Fund was established under the authority of Article 102.017(c)

of the Texas Code of Criminal Procedure to finance the purchase of Security Personnel and Security services

along with items related to the buildings that house the operations of Municipal Court.

The Court Technology Project of the Special Purpose Fund was established under the authority of Article

102.0172 of the Texas Code of Criminal Procedure to finance the purchase and maintenance of technological

enhancements for the Municipal Court.

235