Page 231 - City of Fort Worth Budget Book

P. 231

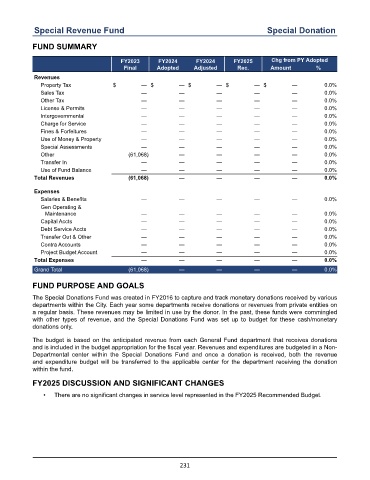

Special Revenue Fund Special Donation

FUND SUMMARY

FY2023 FY2024 FY2024 FY2025 Chg from PY Adopted

Final Adopted Adjusted Rec. Amount %

Revenues

Property Tax $ — $ — $ — $ — $ — 0.0 %

Sales Tax — — — — — 0.0 %

Other Tax — — — — — 0.0 %

License & Permits — — — — — 0.0 %

Intergovernmental — — — — — 0.0 %

Charge for Service — — — — — 0.0 %

Fines & Forfeitures — — — — — 0.0 %

Use of Money & Property — — — — — 0.0 %

Special Assessments — — — — — 0.0 %

Other (61,068) — — — — 0.0 %

Transfer In — — — — — 0.0 %

Use of Fund Balance — — — — — 0.0 %

Total Revenues (61,068) — — — — 0.0 %

Expenses

Salaries & Benefits — — — — — 0.0 %

Gen Operating &

Maintenance — — — — — 0.0 %

Capital Accts — — — — — 0.0 %

Debt Service Accts — — — — — 0.0 %

Transfer Out & Other — — — — — 0.0 %

Contra Accounts — — — — — 0.0 %

Project Budget Account — — — — — 0.0 %

Total Expenses — — — — — 0.0 %

Grand Total (61,068) — — — — 0.0 %

FUND PURPOSE AND GOALS

The Special Donations Fund was created in FY2016 to capture and track monetary donations received by various

departments within the City. Each year some departments receive donations or revenues from private entities on

a regular basis. These revenues may be limited in use by the donor. In the past, these funds were commingled

with other types of revenue, and the Special Donations Fund was set up to budget for these cash/monetary

donations only.

The budget is based on the anticipated revenue from each General Fund department that receives donations

and is included in the budget appropriation for the fiscal year. Revenues and expenditures are budgeted in a Non-

Departmental center within the Special Donations Fund and once a donation is received, both the revenue

and expenditure budget will be transferred to the applicable center for the department receiving the donation

within the fund.

FY2025 DISCUSSION AND SIGNIFICANT CHANGES

• There are no significant changes in service level represented in the FY2025 Recommended Budget.

231