Page 10 - CityofColleyvilleFY25AdoptedBudget

P. 10

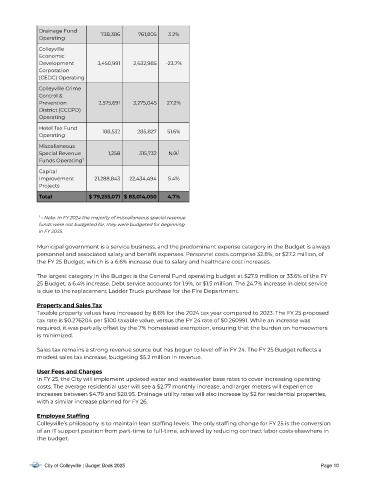

Drainage Fund 738,386 761,805 3.2%

Operating

Colleyville

Economic

Development 3,450,991 2,632,985 -23.7%

Corporation

(CEDC) Operating

Colleyville Crime

Control &

Prevention 2,575,691 3,275,045 27.2%

District (CCCPD)

Operating

Hotel Tax Fund 188,532 285,827 51.6%

Operating

Miscellaneous

Special Revenue 1,258 315,732 N/A 1

Funds Operating 1

Capital

Improvement 21,288,843 22,434,494 5.4%

Projects

Total $ 79,255,071 $ 83,014 ,050 4 .7%

1 - Note: In FY 2024 the majority of miscellaneous special revenue

funds were not budgeted for, they were budgeted for beginning

in FY 2025.

Municipal government is a service business, and the predominant expense category in the Budget is always

personnel and associated salary and bene t expenses. Personnel costs comprise 32.8%, or $27.2 million, of

the FY 25 Budget, which is a 6.6% increase due to salary and healthcare cost increases.

The largest category in the Budget is the General Fund operating budget at $27.9 million or 33.6% of the FY

25 Budget, a 6.4% increase. Debt service accounts for 1.9%, or $1.5 million. The 24.7% increase in debt service

is due to the replacement Ladder Truck purchase for the Fire Department.

Proper ty and Sales Tax

Taxable property values have increased by 8.6% for the 2024 tax year compared to 2023. The FY 25 proposed

tax rate is $0.276204 per $100 taxable value, versus the FY 24 rate of $0.260991. While an increase was

required, it was partially offset by the 7% homestead exemption, ensuring that the burden on homeowners

is minimized.

Sales tax remains a strong revenue source but has begun to level off in FY 24. The FY 25 Budget re ects a

modest sales tax increase, budgeting $5.2 million in revenue.

User Fees and Charges

In FY 25, the City will implement updated water and wastewater base rates to cover increasing operating

costs. The average residential user will see a $2.77 monthly increase, and larger meters will experience

increases between $4.79 and $20.95. Drainage utility rates will also increase by $2 for residential properties,

with a similar increase planned for FY 26.

Employee Staf{ng

Colleyville’s philosophy is to maintain lean staf ng levels. The only staf ng change for FY 25 is the conversion

of an IT support position from part-time to full-time, achieved by reducing contract labor costs elsewhere in

the budget.

City of Colleyville | Budget Book 2025 Page 10