Page 32 - Bedford-FY24-25 Budget

P. 32

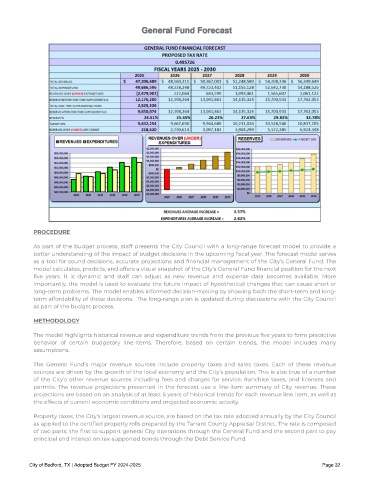

General Fund Forecast

PROCEDURE

As part of the budget process, staff presents the City Council with a long-range forecast model to provide a

better understanding of the impact of budget decisions in the upcoming scal year. The forecast model serves

as a tool for sound decisions, accurate projections and nancial management of the City’s General Fund. The

model calculates, predicts, and offers a visual snapshot of the City’s General Fund nancial position for the next

ve years. It is dynamic and staff can adjust as new revenue and expense data becomes available. More

importantly, the model is used to evaluate the future impact of hypothetical changes that can cause short or

long-term problems. The model enables informed decision-making by showing both the short-term and long-

term affordability of those decisions. The long-range plan is updated during discussions with the City Council

as part of the budget process.

METHODOLOGY

The model highlights historical revenue and expenditure trends from the previous ve years to form predictive

behavior of certain budgetary line-items. Therefore, based on certain trends, the model includes many

assumptions.

The General Fund’s major revenue sources include property taxes and sales taxes. Each of these revenue

sources are driven by the growth of the local economy and the City’s population. This is also true of a number

of the City’s other revenue sources including fees and charges for service, franchise taxes, and licenses and

permits. The revenue projections presented in the forecast use a line-item summary of City revenue. These

projections are based on an analysis of at least 5 years of historical trends for each revenue line item, as well as

the effects of current economic conditions and projected economic activity.

Property taxes, the City’s largest revenue source, are based on the tax rate adopted annually by the City Council

as applied to the certi ed property rolls prepared by the Tarrant County Appraisal District. The rate is composed

of two parts; the rst to support general City operations through the General Fund and the second part to pay

principal and interest on tax-supported bonds through the Debt Service Fund.

City of Bedford, TX | Adopted Budget FY 2024-2025 Page 32