Page 209 - Bedford-FY24-25 Budget

P. 209

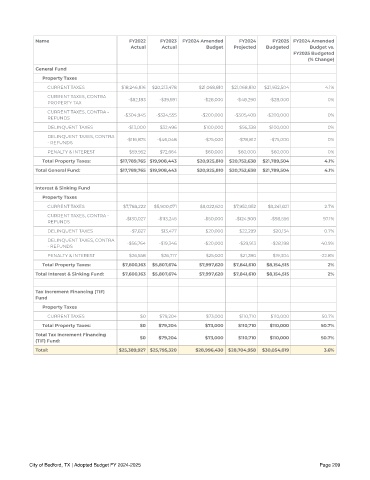

Name FY2022 FY2023 FY2024 Amended FY2024 FY2025 FY2024 Amended

Ac tual Ac tual Budget Projec ted Budgeted Budget vs.

FY2025 Budgeted

(% Change)

General Fund

Proper ty Taxes

CURRENT TAXES $18,246,816 $20,213,478 $21,068,810 $21,068,810 $21,932,504 4.1%

CURRENT TAXES, CONTRA -$82,183 -$39,591 -$28,000 -$48,290 -$28,000 0%

PROPERTY TAX

CURRENT TAXES, CONTRA - -$304,945 -$324,555 -$200,000 -$305,408 -$200,000 0%

REFUNDS

DELINQUENT TAXES -$13,000 $32,496 $100,000 $56,338 $100,000 0%

DELINQUENT TAXES, CONTRA -$116,875 -$46,048 -$75,000 -$78,812 -$75,000 0%

- REFUNDS

PENALTY & INTEREST $59,952 $72,664 $60,000 $60,000 $60,000 0%

Total Proper ty Taxes: $17,789,765 $19,908 ,443 $20,925, 810 $20,752 ,638 $21,789,504 4 .1%

Total General Fund: $17,789,765 $19,908 ,443 $20,925, 810 $20,752 ,638 $21,789,504 4 .1%

Interest & Sinking Fund

Proper ty Taxes

CURRENT TAXES $7,768,222 $5,900,071 $8,022,620 $7,952,852 $8,241,821 2.7%

CURRENT TAXES, CONTRA - -$130,027 -$113,245 -$50,000 -$124,908 -$98,556 97.1%

REFUNDS

DELINQUENT TAXES -$7,827 $13,477 $20,000 $22,299 $20,134 0.7%

DELINQUENT TAXES, CONTRA -$56,764 -$19,346 -$20,000 -$29,913 -$28,188 40.9%

- REFUNDS

PENALTY & INTEREST $26,558 $26,717 $25,000 $21,280 $19,304 -22.8%

Total Proper ty Taxes: $7,600,163 $5, 807,674 $7,997,620 $7, 841,610 $8 ,154 ,515 2 %

Total Interest & Sinking Fund: $7,600,163 $5, 807,674 $7,997,620 $7, 841,610 $8 ,154 ,515 2 %

Tax Increment Financing (TIF)

Fund

Proper ty Taxes

CURRENT TAXES $0 $79,204 $73,000 $110,710 $110,000 50.7%

Total Proper ty Taxes: $0 $79, 204 $73,000 $110,7 10 $110,000 50.7%

Total Tax Increment Financing

$0 $79, 204 $73,000 $110,7 10 $110,000 50.7%

(TIF) Fund:

Total: $25, 389,927 $25,795, 320 $28 ,996 ,430 $28 ,704 ,958 $30,054 ,019 3.6%

City of Bedford, TX | Adopted Budget FY 2024-2025 Page 209