Page 207 - Bedford-FY24-25 Budget

P. 207

Property Taxes Summary

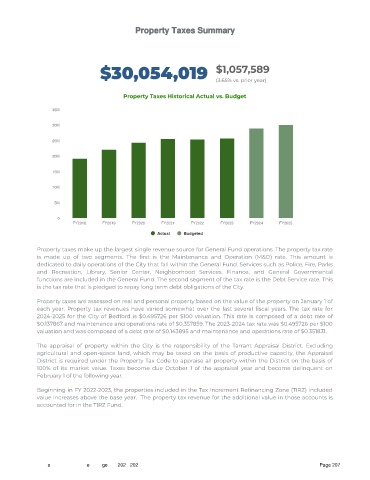

A30,054,019 $1,057,589

(3.65% vs. prior year)

Proper ty Taxes Historical Actual vs. Budget

35M

30M

25M

20M

15M

10M

5M

0

FY2018 FY2019 FY2020 FY2021 FY2022 FY2023 FY2024 FY2025

Actual Budgeted

Property taxes make up the largest single revenue source for General Fund operations. The property tax rate

is made up of two segments. The rst is the Maintenance and Operation (M&O) rate. This amount is

dedicated to daily operations of the City that fall within the General Fund. Services such as Police, Fire, Parks

and Recreation, Library, Senior Center, Neighborhood Services, Finance, and General Governmental

functions are included in the General Fund. The second segment of the tax rate is the Debt Service rate. This

is the tax rate that is pledged to repay long term debt obligations of the City.

Property taxes are assessed on real and personal property based on the value of the property on January 1 of

each year. Property tax revenues have varied somewhat over the last several scal years. The tax rate for

2024-2025 for the City of Bedford is $0.495726 per $100 valuation. This rate is composed of a debt rate of

$0.137867 and maintenance and operations rate of $0.357859. The 2023-2024 tax rate was $0.495726 per $100

valuation and was composed of a debt rate of $0.143895 and maintenance and operations rate of $0.351831.

The appraisal of property within the City is the responsibility of the Tarrant Appraisal District. Excluding

agricultural and open-space land, which may be taxed on the basis of productive capacity, the Appraisal

District is required under the Property Tax Code to appraise all property within the District on the basis of

100% of its market value. Taxes become due October 1 of the appraisal year and become delinquent on

February 1 of the following year.

Beginning in FY 2022-2023, the properties included in the Tax Increment Re nancing Zone (TIRZ) included

value increases above the base year. The property tax revenue for the additional value in those accounts is

accounted for in the TIRZ Fund.

City of Bedford, TX | Adopted Budget FY 2024-2025 Page 207