Page 61 - CITY OF AZLE, TEXAS

P. 61

GENERAL FUND – IN BRIEF

REVENUES

The General Fund budget provides for estimated revenues of $16,772,759 during FY 2024-25.

This reflects an increase of $15,876 (0.09%) over the adopted FY 2023-24 budget. The

majority of General Fund revenue is comprised of the various taxes levied by the City, totaling

78.7% of all fund revenue. This year’s General Fund ad valorem tax levy is projected to be

$8,933,009, which is an increase of $890,876 (11.08%) over last year’s budgeted levy and is

derived from a net taxable value of $1,677,767,961. This increase is offset by a significant

reduction in intergovernmental revenue that is discussed below. Because the City of Azle lies in

both Tarrant County and Parker County, the net taxable value is determined by the Tarrant

Appraisal District and the Parker County Appraisal District. Each district provides a certified tax

th

roll to the City on or around July 25 each year. Net taxable values increased $135,489,686

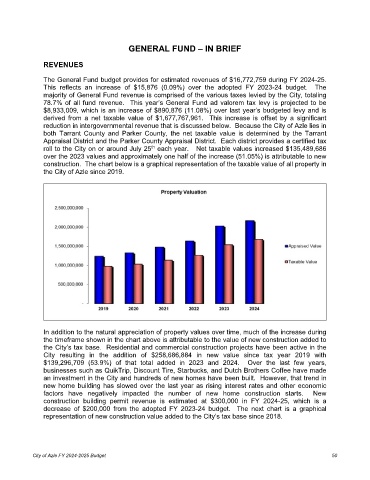

over the 2023 values and approximately one half of the increase (51.05%) is attributable to new

construction. The chart below is a graphical representation of the taxable value of all property in

the City of Azle since 2019.

In addition to the natural appreciation of property values over time, much of the increase during

the timeframe shown in the chart above is attributable to the value of new construction added to

the City’s tax base. Residential and commercial construction projects have been active in the

City resulting in the addition of $258,686,884 in new value since tax year 2019 with

$139,296,709 (53.9%) of that total added in 2023 and 2024. Over the last few years,

businesses such as QuikTrip, Discount Tire, Starbucks, and Dutch Brothers Coffee have made

an investment in the City and hundreds of new homes have been built. However, that trend in

new home building has slowed over the last year as rising interest rates and other economic

factors have negatively impacted the number of new home construction starts. New

construction building permit revenue is estimated at $300,000 in FY 2024-25, which is a

decrease of $200,000 from the adopted FY 2023-24 budget. The next chart is a graphical

representation of new construction value added to the City’s tax base since 2018.

City of Azle FY 2024-2025 Budget 50