Page 25 - CITY OF AZLE, TEXAS

P. 25

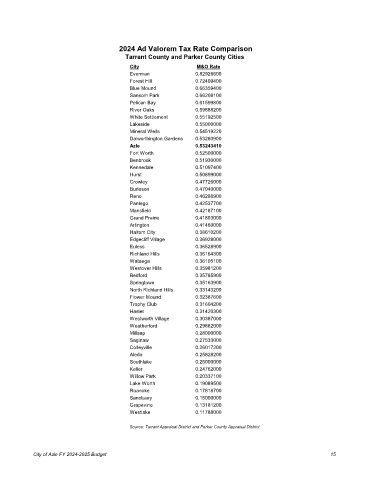

2024 Ad Valorem Tax Rate Comparison

Tarrant County and Parker County Cities

City M&O Rate

Everman 0.82926600

Forest Hill 0.72409400

Blue Mound 0.66359400

Sansom Park 0.66208100

Pelican Bay 0.61599800

River Oaks 0.59888200

White Settlement 0.55192500

Lakeside 0.55000000

Mineral Wells 0.54519220

Dalworthington Gardens 0.53260900

Azle 0.53243410

Fort Worth 0.52500000

Benbrook 0.51930000

Kennedale 0.51097400

Hurst 0.50899000

Crowley 0.47726000

Burleson 0.47040000

Reno 0.46286900

Pantego 0.42537700

Mansfield 0.42187100

Grand Prairie 0.41803000

Arlington 0.41460000

Haltom City 0.38610200

Edgecliff Village 0.36928000

Euless 0.36528900

Richland Hills 0.36164300

Watauga 0.36105100

Westover Hills 0.35981200

Bedford 0.35785900

Springtown 0.35163900

North Richland Hills 0.33143200

Flower Mound 0.32387600

Trophy Club 0.31604200

Haslet 0.31420300

Westworth Village 0.30387000

Weatherford 0.29882000

Millsap 0.28000000

Saginaw 0.27533000

Colleyville 0.26017200

Aledo 0.25828200

Southlake 0.25000000

Keller 0.24762000

Willow Park 0.20337100

Lake Worth 0.19089500

Roanoke 0.17818700

Sanctuary 0.15000000

Grapevine 0.13181200

Westlake 0.11788000

Source: Tarrant Appraisal District and Parker County Appraisal District

City of Azle FY 2024-2025 Budget 15