Page 242 - FY 2025 Adopted Operating Budget and Business Plan

P. 242

Debt Service Fund Return to Table of Contents

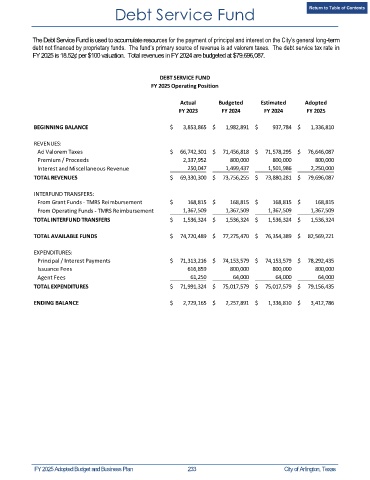

The Debt Service Fund is used to accumulate resources for the payment of principal and interest on the City’s general long-term

debt not financed by proprietary funds. The fund’s primary source of revenue is ad valorem taxes. The debt service tax rate in

FY 2025 is 18.52¢ per $100 valuation. Total revenues in FY 2024 are budgeted at $79,696,087.

DEBT SERVICE FUND

FY 2025 Operating Position

Actual Budgeted Estimated Adopted

FY 2023 FY 2024 FY 2024 FY 2025

BEGINNING BALANCE $ 3,853,865 $ 1,982,891 $ 937,784 $ 1,336,810

REVENUES:

Ad Valorem Taxes $ 66,742,301 $ 71,456,818 $ 71,578,295 $ 76,646,087

Premium / Proceeds 2,337,952 800,000 800,000 800,000

Interest and Miscellaneous Revenue 250,047 1,499,437 1,501,986 2,250,000

TOTAL REVENUES $ 69,330,300 $ 73,756,255 $ 73,880,281 $ 79,696,087

INTERFUND TRANSFERS:

From Grant Funds - TMRS Reimbursement $ 168,815 $ 168,815 $ 168,815 $ 168,815

From Operating Funds - TMRS Reimbursement 1,367,509 1,367,509 1,367,509 1,367,509

TOTAL INTERFUND TRANSFERS $ 1,536,324 $ 1,536,324 $ 1,536,324 $ 1,536,324

TOTAL AVAILABLE FUNDS $ 74,720,489 $ 77,275,470 $ 76,354,389 $ 82,569,221

EXPENDITURES:

Principal / Interest Payments $ 71,313,216 $ 74,153,579 $ 74,153,579 $ 78,292,435

Issuance Fees 616,859 800,000 800,000 800,000

Agent Fees 61,250 64,000 64,000 64,000

TOTAL EXPENDITURES $ 71,991,324 $ 75,017,579 $ 75,017,579 $ 79,156,435

ENDING BALANCE $ 2,729,165 $ 2,257,891 $ 1,336,810 $ 3,412,786

FY 2025 Adopted Budget and Business Plan 233 City of Arlington, Texas