Page 13 - FY 2025 Adopted Operating Budget and Business Plan

P. 13

Budget In Brief Return to Table of Contents

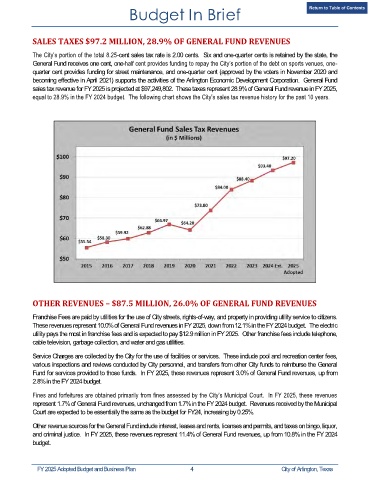

SALES TAXES $97.2 MILLION, 28.9% OF GENERAL FUND REVENUES

The City’s portion of the total 8.25-cent sales tax rate is 2.00 cents. Six and one-quarter cents is retained by the state, the

General Fund receives one cent, one-half cent provides funding to repay the City’s portion of the debt on sports venues, one-

quarter cent provides funding for street maintenance, and one-quarter cent (approved by the voters in November 2020 and

becoming effective in April 2021) supports the activities of the Arlington Economic Development Corporation. General Fund

sales tax revenue for FY 2025 is projected at $97,249,802. These taxes represent 28.9% of General Fund revenue in FY 2025,

equal to 28.9% in the FY 2024 budget. The following chart shows the City’s sales tax revenue history for the past 10 years.

OTHER REVENUES – $87.5 MILLION, 26.0% OF GENERAL FUND REVENUES

Franchise Fees are paid by utilities for the use of City streets, rights-of-way, and property in providing utility service to citizens.

These revenues represent 10.0% of General Fund revenues in FY 2025, down from 12.1% in the FY 2024 budget. The electric

utility pays the most in franchise fees and is expected to pay $12.9 million in FY 2025. Other franchise fees include telephone,

cable television, garbage collection, and water and gas utilities.

Service Charges are collected by the City for the use of facilities or services. These include pool and recreation center fees,

various inspections and reviews conducted by City personnel, and transfers from other City funds to reimburse the General

Fund for services provided to those funds. In FY 2025, these revenues represent 3.0% of General Fund revenues, up from

2.8% in the FY 2024 budget.

Fines and forfeitures are obtained primarily from fines assessed by the City’s Municipal Court. In FY 2025, these revenues

represent 1.7% of General Fund revenues, unchanged from 1.7% in the FY 2024 budget. Revenues received by the Municipal

Court are expected to be essentially the same as the budget for FY24, increasing by 0.25%.

Other revenue sources for the General Fund include interest, leases and rents, licenses and permits, and taxes on bingo, liquor,

and criminal justice. In FY 2025, these revenues represent 11.4% of General Fund revenues, up from 10.8% in the FY 2024

budget.

FY 2025 Adopted Budget and Business Plan 4 City of Arlington, Texas