Page 12 - FY 2025 Adopted Operating Budget and Business Plan

P. 12

Budget In Brief Return to Table of Contents

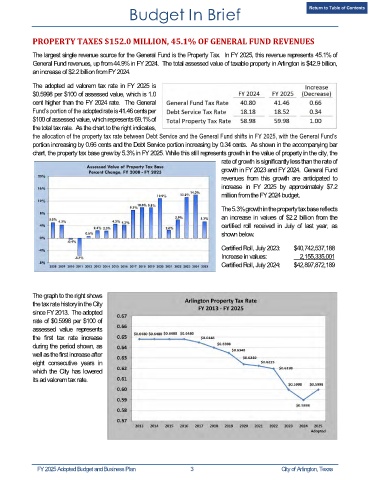

PROPERTY TAXES $152.0 MILLION, 45.1% OF GENERAL FUND REVENUES

The largest single revenue source for the General Fund is the Property Tax. In FY 2025, this revenue represents 45.1% of

General Fund revenues, up from 44.9% in FY 2024. The total assessed value of taxable property in Arlington is $42.9 billion,

an increase of $2.2 billion from FY 2024.

The adopted ad valorem tax rate in FY 2025 is

$0.5998 per $100 of assessed value, which is 1.0

cent higher than the FY 2024 rate. The General

Fund’s portion of the adopted rate is 41.46 cents per

$100 of assessed value, which represents 69.1% of

the total tax rate. As the chart to the right indicates,

the allocation of the property tax rate between Debt Service and the General Fund shifts in FY 2025, with the General Fund’s

portion increasing by 0.66 cents and the Debt Service portion increasing by 0.34 cents. As shown in the accompanying bar

chart, the property tax base grew by 5.3% in FY 2025. While this still represents growth in the value of property in the city, the

rate of growth is significantly less than the rate of

growth in FY 2023 and FY 2024. General Fund

revenues from this growth are anticipated to

increase in FY 2025 by approximately $7.2

million from the FY 2024 budget.

The 5.3% growth in the property tax base reflects

an increase in values of $2.2 billion from the

certified roll received in July of last year, as

shown below.

Certified Roll, July 2023: $40,742,537,188

Increase in values: 2,155,335,001

Certified Roll, July 2024: $42,897,872,189

The graph to the right shows

the tax rate history in the City

since FY 2013. The adopted

rate of $0.5998 per $100 of

assessed value represents

the first tax rate increase

during the period shown, as

well as the first increase after

eight consecutive years in

which the City has lowered

its ad valorem tax rate.

FY 2025 Adopted Budget and Business Plan 3 City of Arlington, Texas