Page 85 - CityofWataugaAdoptedBudgetFY24

P. 85

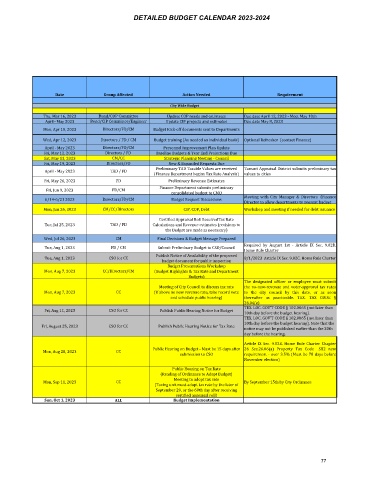

DETAILED BUDGET CALENDAR 2023-2024

Date Group Affected Action Needed Requirement

City Wide Budget

Thu, Mar 16, 2023 Bond/COP Committee Update COP needs and estimates Due date April 12, 2023 - Meet May 10th

April- May 2023 Bond/CIP Committee/Engineer Update CIP projects and estimates Due date May 8, 2023

Mon, Apr 10, 2023 Directors/FD/CM Budget Kick-off documents sent to Departments

Wed, Apr 12, 2023 Directors / FD / CM Budget training (As needed on individual basis) Optional Refresher (contact Finance)

April - May 2023 Directors/FD/CM Personnel Improvement Plan Update

Fri, May 12, 2023 Directors / FD Baseline Budgets & Year End Projections Due

Sat, May 13, 2023 CM/CC Strategic Planning Meeting - Council

Fri, May 19, 2023 Directors/FD New & Expanded Requests Due

Preliminary TAD Taxable Values are received Tarrant Appraisal District submits preliminary tax

April - May 2023 TAD / FD

(Finance Department begins Tax Rate Analysis) values to cities

Fri, May 26, 2023 FD Preliminary Revenue Estimates

Finance Department submits preliminary

Fri, Jun 9, 2023 FD/CM

consolidated budget to CMO

Meeting with City Manager & Directors (Finance

6/14-6/21 2023 Directors/FD/CM Budget Request Discussions

Director to allow departments to present budget

Mon, Jun 26, 2023 CM/CC/Directors CIP, COP, Debt Workshop and meeting if needed for debt issuance

Certified Appraisal Roll ReceivedTax Rate

Tue, Jul 25, 2023 TAD / FD Calculations and Revenue estimates (revisions to

the Budget are made as necessary)

Wed, Jul 26, 2023 CM Final Decisions & Budget Message Prepared

Required by August 1st - Article IX Sec. 9.02B.

Tue, Aug 1, 2023 FD / CM Submit Preliminary Budget to CSO/Council

Home Rule Charter

Publish Notice of Availability of the proposed

Tue, Aug 1, 2023 CSO for CC 8/1/2023 Article IX Sec. 9.02C. Home Rule Charter

budget document for public inspection

Budget Presentations Workshop

Mon, Aug 7, 2023 CC/Directors/CM (Budget Highlights & Tax Rate and Department

Budgets)

The designated officer or employee must submit

Meeting of City Council to discuss tax rate the no-new-revenue and voter-approval tax rates

Mon, Aug 7, 2023 CC (if above no new revenue rate, take record vote to the city council by this date, or as soon

and schedule public hearing) thereafter as practicable. TEX. TAX CODE §

26.04(e)

TEX. LOC. GOV’T CODE § 102.0065 (not later than

Fri, Aug 11, 2023 CSO for CC Publish Public Hearing Notice for Budget

10th day before the budget hearing).

TEX. LOC. GOV’T CODE § 102.0065 (not later than

10th day before the budget hearing). Note that the

Fri, August 25, 2023 CSO for CC Publish Public Hearing Notice for Tax Rate

notice may not be published earlier than the 30th

day before the hearing.

Article IX Sec. 9.02E. Home Rule Charter Chapter

Public Hearing on Budget - Must be 15 days after 26 Sec.26.06(a) Property Tax Code SB2 new

Mon, Aug 28, 2023 CC

submission to CSO requirement - over 3.5% (Must be 78 days before

November election)

Public Hearing on Tax Rate

(Reading of Ordinance to Adopt Budget)

Meeting to adopt tax rate

Mon, Sep 11, 2023 CC By September 15th by City Ordinance

(Taxing unit must adopt tax rate by the later of

September 29, or the 60th day after receiving

certified appraisal roll)

Sun, Oct 1, 2023 ALL Budget Implementation

77