Page 315 - CityofWataugaAdoptedBudgetFY24

P. 315

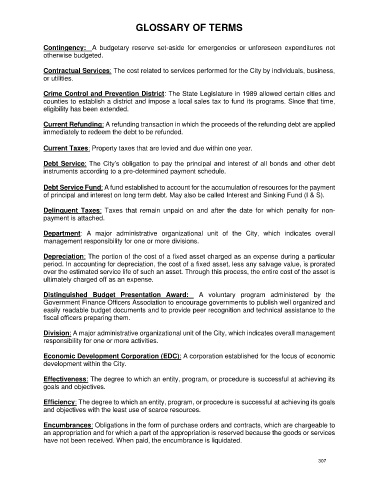

GLOSSARY OF TERMS

Contingency: A budgetary reserve set-aside for emergencies or unforeseen expenditures not

otherwise budgeted.

Contractual Services: The cost related to services performed for the City by individuals, business,

or utilities.

Crime Control and Prevention District: The State Legislature in 1989 allowed certain cities and

counties to establish a district and impose a local sales tax to fund its programs. Since that time,

eligibility has been extended.

Current Refunding: A refunding transaction in which the proceeds of the refunding debt are applied

immediately to redeem the debt to be refunded.

Current Taxes: Property taxes that are levied and due within one year.

Debt Service: The City’s obligation to pay the principal and interest of all bonds and other debt

instruments according to a pre-determined payment schedule.

Debt Service Fund: A fund established to account for the accumulation of resources for the payment

of principal and interest on long term debt. May also be called Interest and Sinking Fund (I & S).

Delinquent Taxes: Taxes that remain unpaid on and after the date for which penalty for non-

payment is attached.

Department: A major administrative organizational unit of the City, which indicates overall

management responsibility for one or more divisions.

Depreciation: The portion of the cost of a fixed asset charged as an expense during a particular

period. In accounting for depreciation, the cost of a fixed asset, less any salvage value, is prorated

over the estimated service life of such an asset. Through this process, the entire cost of the asset is

ultimately charged off as an expense.

Distinguished Budget Presentation Award: A voluntary program administered by the

Government Finance Officers Association to encourage governments to publish well organized and

easily readable budget documents and to provide peer recognition and technical assistance to the

fiscal officers preparing them.

Division: A major administrative organizational unit of the City, which indicates overall management

responsibility for one or more activities.

Economic Development Corporation (EDC): A corporation established for the focus of economic

development within the City.

Effectiveness: The degree to which an entity, program, or procedure is successful at achieving its

goals and objectives.

Efficiency: The degree to which an entity, program, or procedure is successful at achieving its goals

and objectives with the least use of scarce resources.

Encumbrances: Obligations in the form of purchase orders and contracts, which are chargeable to

an appropriation and for which a part of the appropriation is reserved because the goods or services

have not been received. When paid, the encumbrance is liquidated.

307