Page 314 - CityofWataugaAdoptedBudgetFY24

P. 314

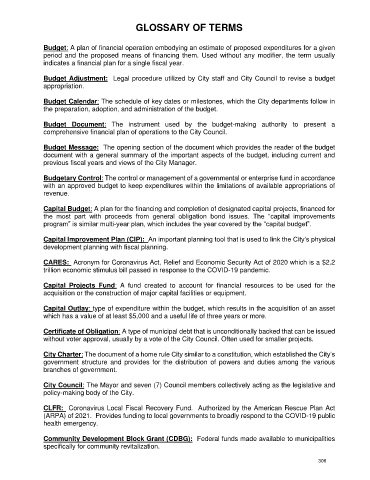

GLOSSARY OF TERMS

Budget: A plan of financial operation embodying an estimate of proposed expenditures for a given

period and the proposed means of financing them. Used without any modifier, the term usually

indicates a financial plan for a single fiscal year.

Budget Adjustment: Legal procedure utilized by City staff and City Council to revise a budget

appropriation.

Budget Calendar: The schedule of key dates or milestones, which the City departments follow in

the preparation, adoption, and administration of the budget.

Budget Document: The instrument used by the budget-making authority to present a

comprehensive financial plan of operations to the City Council.

Budget Message: The opening section of the document which provides the reader of the budget

document with a general summary of the important aspects of the budget, including current and

previous fiscal years and views of the City Manager.

Budgetary Control: The control or management of a governmental or enterprise fund in accordance

with an approved budget to keep expenditures within the limitations of available appropriations of

revenue.

Capital Budget: A plan for the financing and completion of designated capital projects, financed for

the most part with proceeds from general obligation bond issues. The “capital improvements

program” is similar multi-year plan, which includes the year covered by the “capital budget”.

Capital Improvement Plan (CIP): An important planning tool that is used to link the City’s physical

development planning with fiscal planning.

CARES: Acronym for Coronavirus Act, Relief and Economic Security Act of 2020 which is a $2.2

trillion economic stimulus bill passed in response to the COVID-19 pandemic.

Capital Projects Fund: A fund created to account for financial resources to be used for the

acquisition or the construction of major capital facilities or equipment.

Capital Outlay: type of expenditure within the budget, which results in the acquisition of an asset

which has a value of at least $5,000 and a useful life of three years or more.

Certificate of Obligation: A type of municipal debt that is unconditionally backed that can be issued

without voter approval, usually by a vote of the City Council. Often used for smaller projects.

City Charter: The document of a home rule City similar to a constitution, which established the City’s

government structure and provides for the distribution of powers and duties among the various

branches of government.

City Council: The Mayor and seven (7) Council members collectively acting as the legislative and

policy-making body of the City.

CLFR: Coronavirus Local Fiscal Recovery Fund. Authorized by the American Rescue Plan Act

(ARPA) of 2021. Provides funding to local governments to broadly respond to the COVID-19 public

health emergency.

Community Development Block Grant (CDBG): Federal funds made available to municipalities

specifically for community revitalization.

306