Page 224 - CityofWataugaAdoptedBudgetFY24

P. 224

SPECIAL REVENUE FUNDS

STREET MAINTENANCE – FUND 14

The Street Maintenance Fund was established in FY2012-2013 to account for a ¼ cent

sales tax approved by voters on May 12, 2012 for an initial four years effective October

1, 2012. The ¼ cent sales tax was reauthorized by voters on May 2016 for another four

years. The purpose of the sales tax is to provide for the maintenance and repair of

municipal streets in existence at the time of the vote. The Watauga Parks Development

Corporation sales and use tax was reduced by ¼ of one percent effective October 1,

2012.

Street Maintenance sales tax was abolished by voters in November 2020.

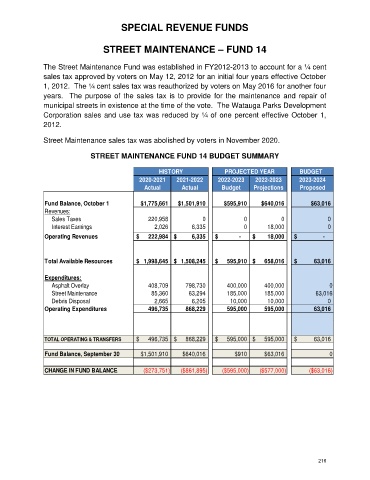

STREET MAINTENANCE FUND 14 BUDGET SUMMARY

HISTORY PROJECTED YEAR BUDGET

2020-2021 2021-2022 2022-2023 2022-2023 2023-2024

Actual Actual Budget Projections Proposed

Fund Balance, October 1 $1,775,661 $1,501,910 $595,910 $640,016 $63,016

Revenues:

Sales Taxes 220,958 0 0 0 0

Interest Earnings 2,026 6,335 0 18,000 0

Operating Revenues $ 222,984 $ 6,335 $ - $ 18,000 $ -

Total Available Resources $ 1,998,645 $ 1,508,245 $ 595,910 $ 658,016 $ 63,016

Expenditures:

Asphalt Overlay 408,709 798,730 400,000 400,000 0

Street Maintenance 85,360 63,294 185,000 185,000 63,016

Debris Disposal 2,665 6,205 10,000 10,000 0

Operating Expenditures 496,735 868,229 595,000 595,000 63,016

TOTAL OPERATING & TRANSFERS $ 496,735 $ 868,229 $ 595,000 $ 595,000 $ 63,016

Fund Balance, September 30 $1,501,910 $640,016 $910 $63,016 0

CHANGE IN FUND BALANCE ($273,751) ($861,895) ($595,000) ($577,000) ($63,016)

216