Page 285 - Southlake FY24 Budget

P. 285

Park Dedication Fee Fund

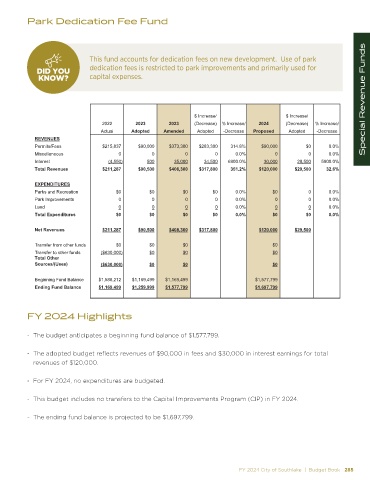

DID YOU This fund accounts for dedication fees on new development. Use of park

SPECIAL REVENUE FUND

KNOW? dedication fees is restricted to park improvements and primarily used for

DID YOU

KNOW? capital expenses. Park Dedication

a

d

n

2

d

s

r

o

P

o

p

e

B

e

d

g

e

u

d

s

3

0

2

v

i

R

e

0

2 2024 Proposed and 2023 Revised Budget t Special Revenue Funds

2

4

$ Increase/ $ Increase/

2022 2023 2023 (Decrease) % Increase/ 2024 (Decrease) % Increase/

Actual Adopted Amended Adopted -Decrease Proposed Adopted -Decrease

REVENUES

Permits/Fees $215,837 $90,000 $373,300 $283,300 314.8% $90,000 $0 0.0%

Miscellaneous 0 0 0 0 0.0% 0 0 0.0%

Interest (4,550) 500 35,000 34,500 6900.0% 30,000 29,500 5900.0%

Total Revenues $211,287 $90,500 $408,300 $317,800 351.2% $120,000 $29,500 32.6%

EXPENDITURES

Parks and Recreation $0 $0 $0 $0 0.0% $0 0 0.0%

Park Improvements 0 0 0 0 0.0% 0 0 0.0%

Land 0 0 0 0 0.0% 0 0 0.0%

Total Expenditures $0 $0 $0 $0 0.0% $0 $0 0.0%

Net Revenues $211,287 $90,500 $408,300 $317,800 $120,000 $29,500

Transfer from other funds $0 $0 $0 $0

Transfer to other funds ($630,000) $0 $0 $0

Total Other

Sources/(Uses) ($630,000) $0 $0 $0

Beginning Fund Balance $1,588,212 $1,169,499 $1,169,499 $1,577,799

Ending Fund Balance $1,169,499 $1,259,999 $1,577,799 $1,697,799

FY 2024 Highlights

- The budget anticipates a beginning fund balance of $1,577,799.

- The adopted budget reflects revenues of $90,000 in fees and $30,000 in interest earnings for total

revenues of $120,000.

- For FY 2024, no expenditures are budgeted.

- This budget includes no transfers to the Capital Improvements Program (CIP) in FY 2024.

- The ending fund balance is projected to be $1,697,799.

FY 2024 City of Southlake | Budget Book 285