Page 283 - Southlake FY24 Budget

P. 283

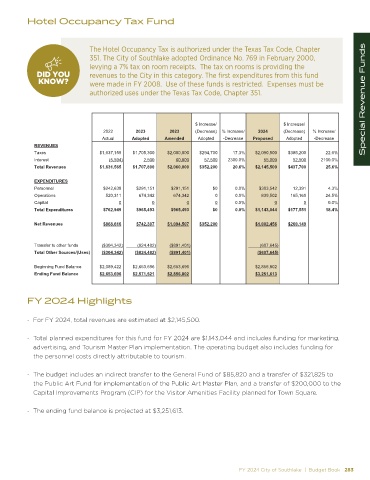

Hotel Occupancy Tax Fund

The Hotel Occupancy Tax is authorized under the Texas Tax Code, Chapter

351. The City of Southlake adopted Ordinance No. 769 in February 2000,

DID YOU levying a 7% tax on room receipts. The tax on rooms is providing the

KNOW? revenues to the City in this category. The first expenditures from this fund

DID YOU

SPECIAL REVENUE FUND

KNOW? were made in FY 2008. Use of these funds is restricted. Expenses must be

Hotel Occupancy

authorized uses under the Texas Tax Code, Chapter 351. Special Revenue Funds

n

d

2

0

a

p

o

r

o

d

s

e

B

u

d

e

t

d

g

e

R

2

3

i

s

e

v

2

4

2 2024 Proposed and 2023 Revised Budget

0

P

$ Increase/ $ Increase/

2022 2023 2023 (Decrease) % Increase/ 2024 (Decrease) % Increase/

Actual Adopted Amended Adopted -Decrease Proposed Adopted -Decrease

REVENUES

Taxes $1,637,159 $1,705,300 $2,000,000 $294,700 17.3% $2,090,500 $385,200 22.6%

Interest (5,594) 2,500 60,000 57,500 2300.0% 55,000 52,500 2100.0%

Total Revenues $1,631,565 $1,707,800 $2,060,000 $352,200 20.6% $2,145,500 $437,700 25.6%

EXPENDITURES

Personnel $242,638 $291,151 $291,151 $0 0.0% $303,542 12,391 4.3%

Operations 520,311 674,342 674,342 0 0.0% 839,502 165,160 24.5%

Capital 0 0 0 0 0.0% 0 0 0.0%

Total Expenditures $762,949 $965,493 $965,493 $0 0.0% $1,143,044 $177,551 18.4%

Net Revenues $868,616 $742,307 $1,094,507 $352,200 $1,002,456 $260,149

Transfer to other funds ($304,342) (824,482) ($891,401) (607,645)

Total Other Sources/(Uses) ($304,342) ($824,482) ($891,401) ($607,645)

Beginning Fund Balance $2,089,422 $2,653,696 $2,653,696 $2,856,802

Ending Fund Balance $2,653,696 $2,571,521 $2,856,802 $3,251,613

FY 2024 Highlights

- For FY 2024, total revenues are estimated at $2,145,500.

- Total planned expenditures for this fund for FY 2024 are $1,143,044 and includes funding for marketing,

advertising, and Tourism Master Plan implementation. The operating budget also includes funding for

the personnel costs directly attributable to tourism.

- The budget includes an indirect transfer to the General Fund of $85,820 and a transfer of $321,825 to

the Public Art Fund for implementation of the Public Art Master Plan, and a transfer of $200,000 to the

Capital Improvements Program (CIP) for the Visitor Amenities Facility planned for Town Square.

- The ending fund balance is projected at $3,251,613.

FY 2024 City of Southlake | Budget Book 283