Page 7 - Saginaw FY24 Adopted Budget

P. 7

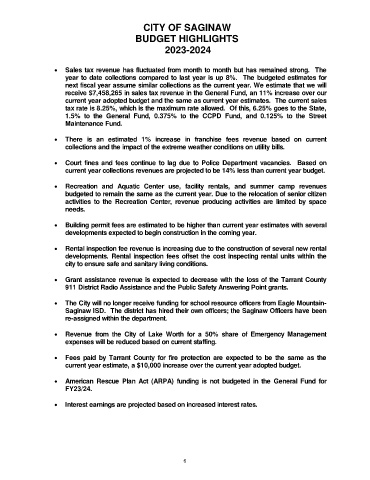

CITY OF SAGINAW

BUDGET HIGHLIGHTS

2023-2024

• Sales tax revenue has fluctuated from month to month but has remained strong. The

year to date collections compared to last year is up 8%. The budgeted estimates for

next fiscal year assume similar collections as the current year. We estimate that we will

receive $7,458,265 in sales tax revenue in the General Fund, an 11% increase over our

current year adopted budget and the same as current year estimates. The current sales

tax rate is 8.25%, which is the maximum rate allowed. Of this, 6.25% goes to the State,

1.5% to the General Fund, 0.375% to the CCPD Fund, and 0.125% to the Street

Maintenance Fund.

• There is an estimated 1% increase in franchise fees revenue based on current

collections and the impact of the extreme weather conditions on utility bills.

• Court fines and fees continue to lag due to Police Department vacancies. Based on

current year collections revenues are projected to be 14% less than current year budget.

• Recreation and Aquatic Center use, facility rentals, and summer camp revenues

budgeted to remain the same as the current year. Due to the relocation of senior citizen

activities to the Recreation Center, revenue producing activities are limited by space

needs.

• Building permit fees are estimated to be higher than current year estimates with several

developments expected to begin construction in the coming year.

• Rental inspection fee revenue is increasing due to the construction of several new rental

developments. Rental inspection fees offset the cost inspecting rental units within the

city to ensure safe and sanitary living conditions.

• Grant assistance revenue is expected to decrease with the loss of the Tarrant County

911 District Radio Assistance and the Public Safety Answering Point grants.

• The City will no longer receive funding for school resource officers from Eagle Mountain-

Saginaw ISD. The district has hired their own officers; the Saginaw Officers have been

re-assigned within the department.

• Revenue from the City of Lake Worth for a 50% share of Emergency Management

expenses will be reduced based on current staffing.

• Fees paid by Tarrant County for fire protection are expected to be the same as the

current year estimate, a $10,000 increase over the current year adopted budget.

• American Rescue Plan Act (ARPA) funding is not budgeted in the General Fund for

FY23/24.

• Interest earnings are projected based on increased interest rates.

6