Page 3 - PantegoFY24AdoptedBudget

P. 3

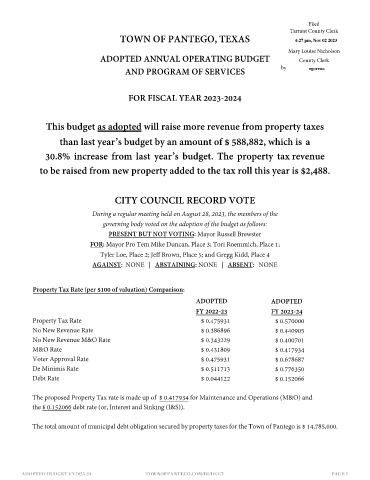

Filed

Tarrant County Clerk

TOWN OF PANTEGO, TEXAS 4:27 pm, Nov 02 2023

Mary Louise Nicholson

ADOPTED ANNUAL OPERATING BUDGET County Clerk

AND PROGRAM OF SERVICES by ngorena

FOR FISCAL YEAR 2023-2024

This budget as adopted will raise more revenue from property taxes

than last year’s budget by an amount of $ 588,882, which is a

30.8% tax revenue

to be raised from new property added to the tax roll this year is $2,488.

CITY COUNCIL RECORD VOTE

During a regular meeting held on August 28, 2023, the members of the

governing body voted on the adoption of the budget as follows:

PRESENT BUT NOT VOTING: Mayor Russell Brewster

FOR: Mayor Pro Tem Mike Duncan, Place 3; Tori Roemmich, Place 1;

Tyler Loe, Place 2; Jeff Brown, Place 5; and Gregg Kidd, Place 4

AGAINST: NONE | ABSTAINING: NONE | ABSENT: NONE

Property Tax Rate (per $100 of valuation) Comparison:

ADOPTED ADOPTED

FY 2022-23 FY 2023-24

Property Tax Rate $ 0.475931 $ 0.570000

No New Revenue Rate $ 0.386896 $ 0.440905

No New Revenue M&O Rate $ 0.343229 $ 0.400701

M&O Rate $ 0.431809 $ 0.417934

Voter Approval Rate $ 0.475931 $ 0.678687

De Minimis Rate $ 0.511713 $ 0.776350

Debt Rate $ 0.044122 $ 0.152066

The proposed Property Tax rate is made up of $ 0.417934 for Maintenance and Operations (M&O) and

the $ 0.152066 debt rate (or, Interest and Sinking (I&S)).

The total amount of municipal debt obligation secured by property taxes for the Town of Pantego is $ 14,785,000.

ADOPTED BUDGET FY2023-24 TOWNOFPANTEGO.COM/BUDGET PAGE 1