Page 9 - NorthRichlandHillsFY24AdoptedBudget

P. 9

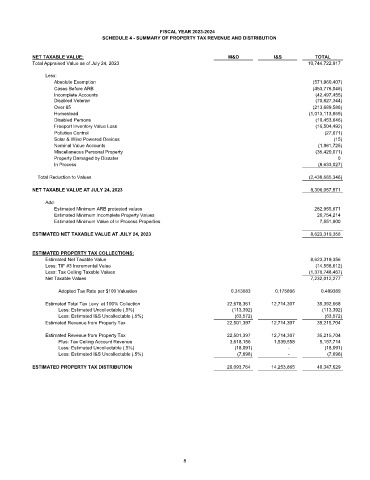

FISCAL YEAR 2023-2024

SCHEDULE 4 - SUMMARY OF PROPERTY TAX REVENUE AND DISTRIBUTION

NET TAXABLE VALUE: M&O I&S TOTAL

Total Appraised Value as of July 24, 2023 10,744,722,917

Less:

Absolute Exemption (571,960,407)

Cases Before ARB (453,776,046)

Incomplete Accounts (42,497,455)

Disabled Veteran (70,627,344)

Over 65 (213,689,588)

Homestead (1,013,113,859)

Disabled Persons (10,453,646)

Freeport Inventory Value Loss (16,504,492)

Pollution Control (27,671)

Solar & Wind Powered Devices (15)

Nominal Value Accounts (1,961,725)

Miscellaneous Personal Property (35,420,071)

Property Damaged by Disaster 0

In Process (8,633,027)

Total Reduction to Values (2,438,665,346)

NET TAXABLE VALUE AT JULY 24, 2023 8,306,057,571

Add:

Estimated Minimum ARB protested values 282,955,671

Estimated Minimum Incomplete Property Values 26,754,214

Estimated Minimum Value of In Process Properties 7,551,900

ESTIMATED NET TAXABLE VALUE AT JULY 24, 2023 8,623,319,356

ESTIMATED PROPERTY TAX COLLECTIONS:

Estimated Net Taxable Value 8,623,319,356

Less: TIF #3 Incremental Value (14,558,612)

Less: Tax Ceiling Taxable Values (1,376,748,467)

Net Taxable Values 7,232,012,277

Adopted Tax Rate per $100 Valuation 0.313583 0.175806 0.489389

Estimated Total Tax Levy at 100% Collection 22,678,361 12,714,307 35,392,668

Less: Estimated Uncollectable (.5%) (113,392) (113,392)

Less: Estimated I&S Uncollectable (.5%) (63,572) (63,572)

Estimated Revenue from Property Tax 22,501,397 12,714,307 35,215,704

Estimated Revenue from Property Tax 22,501,397 12,714,307 35,215,704

Plus: Tax Ceiling Account Revenue 3,618,156 1,539,558 5,157,714

Less: Estimated Uncollectable (.5%) (18,091) - (18,091)

Less: Estimated I&S Uncollectable (.5%) (7,698) - (7,698)

ESTIMATED PROPERTY TAX DISTRIBUTION 26,093,764 14,253,865 40,347,629

8