Page 52 - Lake Worth Adopted Budget FY 23-24

P. 52

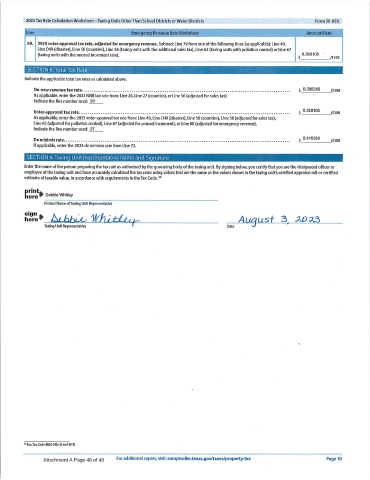

2023 Tax Rate Calculation Worksheet—Taxing Units Other Than School Districts or Water Districts Form 50- 856

Line Emergency Revenue Rate Worksheet Amount/Rate

80. 2023 voter -approval tax rate, adjusted for emergency revenue. Subtract Line 79 from one of the following lines (as applicable): Line 49,

Line D49 (disaster), Line 50 (counties), Line 58 (taxing units with the additional sales tax), Line 62 (taxing units with pollution control) or Line 67

taxing units with the unused increment rate). $ 06390105 /$

100

SECTIONTotal

Indicate the applicable total tax rates as calculated above.

No -new -revenue tax rate................................................................................................................. S 0.398246 / St00

As applicable, enter the 2023 NNR tax rate from: Line 26, Line 27 (counties), or Line 56 (adjusted for sales tax).

Indicate the line number used: 26

Voter-aJobprovaltax rate................................................................................................................... S 0.390105 / S1oo

As applicable, enter the 2023 voter -approval tax rate from: Line 49, Line D49 (disaster), Line 50 (counties), Line 58 (adjusted for sales tax),

Line 62 (adjusted for pollution control), Line 67 (adjusted for unused increment), or Line 80 (adjusted for emergency revenue).

Indicate the line number used: 27

Deminimis rate........................................................................................................................... S 0.445369 / S1oo

If applicable, enter the 2023 de minimis rate from Line 72,

Enter the name of the person preparing the tax rate as authorized by the governing body ofthe taxing unit. By signing below, you certify that you are the designated officer or

employee of the taxing unit and have accurately calculated the tax rates using values that are the same as the values shown in the taxing unit's certified appraisal roll or certified

estimate of taxable value, in accordance with requirements in the Tax Code. 50

print

here Debbie Whitley

Printed Name ofTax] Unit Representative

sign

here

Taxing Unit Representative Date

S' Tex, TaxGode 4426.04(c-2) and (d-2)

Attachment A Page 48 of 48 For additional copies, visit: comptrollertexas.gov/taxes/property-tax Page 10